Bitcoin (BTC) has been on a bit of a rollercoaster lately. After briefly hitting a high above $99,000, it’s dipped below $95,000, leaving some wondering about the future of its upward trend.

A Rocky Road

The past few days haven’t been kind to Bitcoin. A big hack of crypto exchange Bybit wiped out some recent gains, and the price has been struggling. It briefly touched $97,000 on Saturday, but Monday saw it fall to a one-week low of around $93,800. Analyst Jelle notes a pattern of Bitcoin dropping when the US markets open.

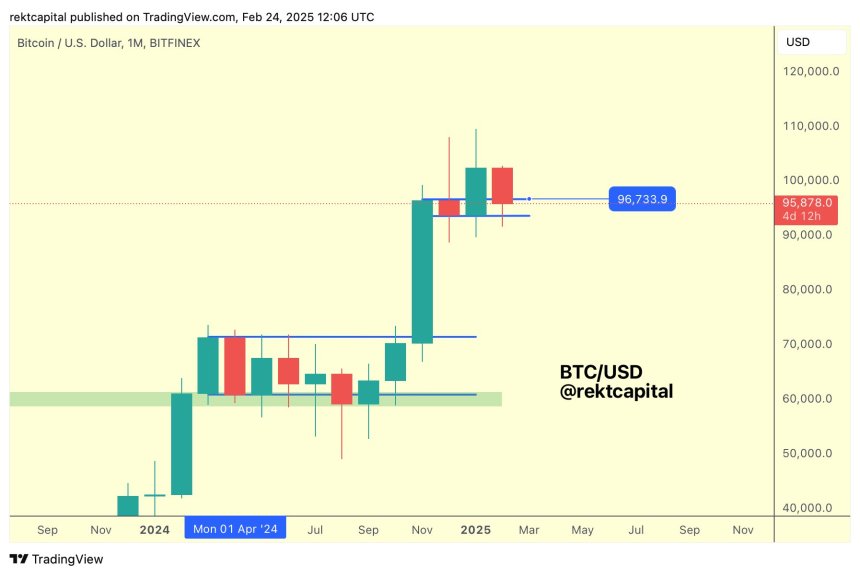

Despite this, Bitcoin has stayed within a relatively narrow range since November, between roughly $96,000 and $102,000. This suggests some underlying stability, even with the recent dips.

Key Levels to Watch

Altcoin Sherpa points out that Bitcoin hasn’t closed below its daily support zone for over a month (excluding February 18th). He believes closing above $95,700 is crucial for maintaining this support.

Meanwhile, Rekt Capital focuses on the bigger picture. He says a monthly close above $96,000 is needed to confirm the continuation of Bitcoin’s long-term bullish trend. January’s close above $100,000 was a significant milestone, confirming a breakout. But the recent drop means Bitcoin is retesting that breakout level. Rekt Capital emphasizes that closing above $96,700 in February is key to confirming this breakout and setting up for continued growth. He also notes that the daily close isn’t as important as the overall monthly trend.

The Bottom Line

Bitcoin is currently trading around $94,000, down about 2% for the day. Whether it can recover and continue its upward trajectory depends on whether it can reclaim those crucial support levels in the coming days and weeks. The analysts’ perspectives highlight the importance of both short-term and long-term price action in determining Bitcoin’s future.