Bitcoin is taking a dip right now, hovering around the $60,000 mark. This isn’t a great start to the fourth quarter, which is usually a good time for Bitcoin.

Miners Slowing Down the Sell-Off

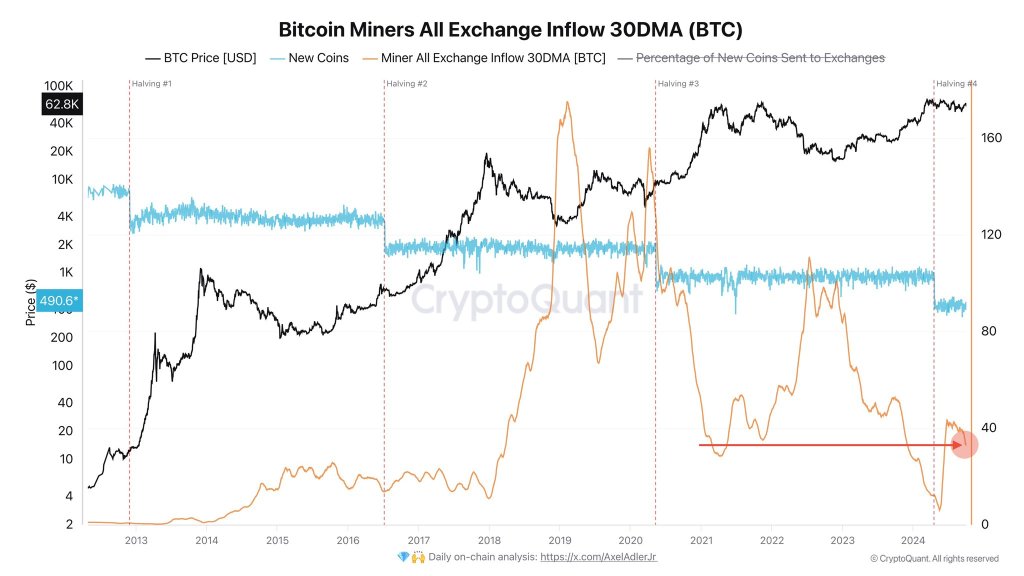

While Bitcoin is down, there’s some good news: Bitcoin miners are selling less of their coins. They’ve been moving fewer coins to exchanges like Binance and Coinbase. This is a big deal because miners usually sell off a lot of their Bitcoin after a “Halving” event, which happened in April.

Halving means that miners get paid less for each new Bitcoin they create. This usually leads to more selling pressure as miners try to make up for the lost income. But this time, they seem to be holding on to their coins, which could be a good sign for Bitcoin’s price.

Will Bitcoin Rise Again?

Miners holding onto their coins could help Bitcoin recover. They seem to think the price will go up in the coming months.

Historically, the fourth quarter, especially October and November, has been good for Bitcoin. But this year, the price has been down for the past few days, making it the worst October start in over a decade.

The Short-Term Outlook

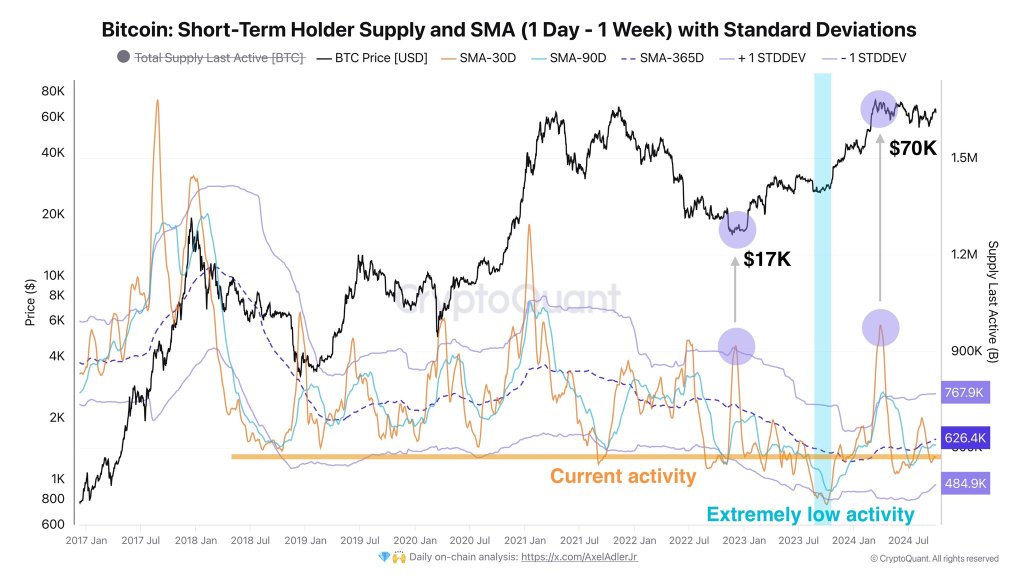

To get back on track, Bitcoin needs some help from short-term holders (STHs). These are people who bought Bitcoin within the last 155 days. They’re often considered speculators, and they can be risky for Bitcoin’s price because they’re more likely to sell if the price drops.

If STHs sell off 80,000 Bitcoin, the price could stabilize around $60,000. But if the selling continues, Bitcoin could fall below $57,000.