Bitcoin’s price has been bouncing around the $80,000 mark lately, with a potential dip on the horizon. Let’s dive into the details.

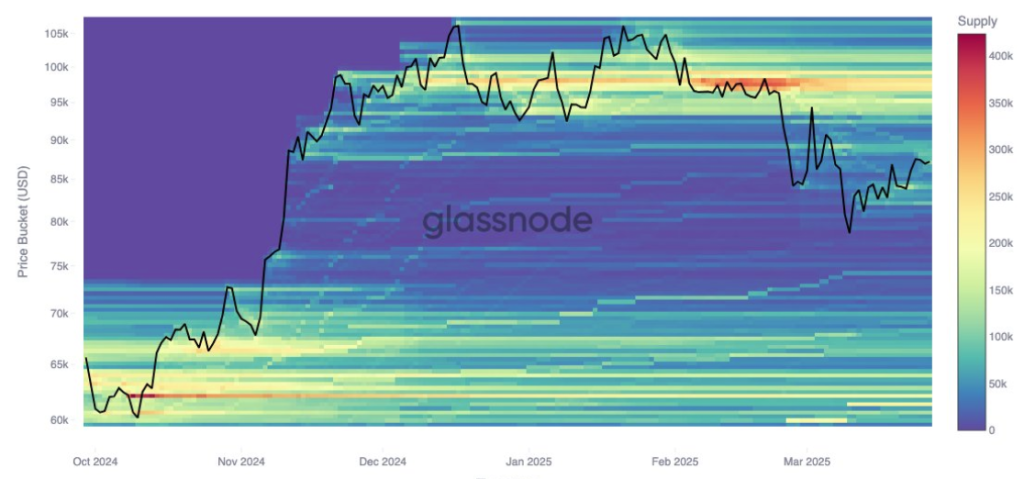

Thinning Support at $78,000

On-chain data reveals a weakening support level around $78,000. There aren’t many buyers left holding Bitcoin at that price, making it a vulnerable point. This is partly due to some savvy traders who bought low in early March (around $77,000) and then sold high near $87,000. They essentially cashed out, leaving less support in that price range.

Shifting Support Levels

However, there’s still some support. Stronger support clusters have formed higher up, between $80,000 and $84,000. A significant number of Bitcoin were bought around $80,920, $82,090, and $84,100. These are the new key levels to watch. At the time of writing, Bitcoin’s price is above $80,920, but if it falls below $80,000, the next significant support levels are at $74,000 and $71,000.

Resistance Building Near $95,000

While support is shifting upwards, resistance is building near $95,000. Since late March, about 12,000 more Bitcoin have accumulated around this price point. This suggests some investors believe $95,000 might be a price ceiling, leading to potential selling pressure if the price approaches it.

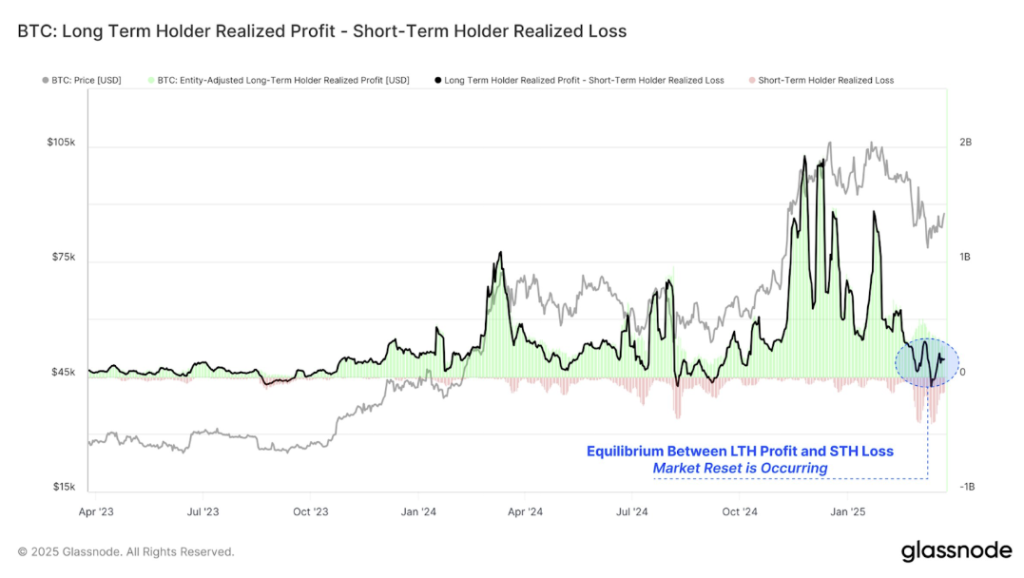

The Big Picture

The combination of rising support and strengthening resistance could keep Bitcoin’s price within a tighter range in the near future. Interestingly, long-term holders are currently selling roughly as much as short-term holders are losing.