Bitcoin’s been stuck in a rut lately, trading sideways after a big drop. It’s lost over 29% since its peak in January and is now trying to find its footing.

The Cup and Handle Conundrum

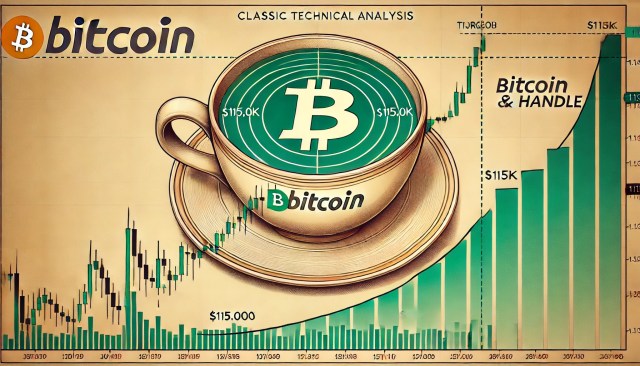

A crypto analyst, Ali Martinez, pointed out that Bitcoin might have formed a “cup and handle” pattern, peaking around $109,000. This pattern sometimes suggests a future price increase, but in this case, it just means Bitcoin’s direction is unclear. The hoped-for breakout above $115,000 hasn’t happened.

A 13% Bounce, But Is It Enough?

Bitcoin did see a decent 13% rebound from its March low near $76,600. Bulls are aiming for $88,000 next, but the overall outlook is still uncertain. Many investors were expecting a big bull run in 2025, but things haven’t gone to plan. Macroeconomic worries are adding to the uncertainty, with some analysts even predicting a bear market.

The $84,000 Battleground

Bitcoin’s currently hovering around $84,100. This price range is a key battleground for bulls and bears. If bulls can push past $87,300 (a key moving average level), it could signal a move towards $90,000 and a short-term uptrend. However, falling below $84,000 could lead to a drop towards $81,000.

What’s Next for Bitcoin?

Essentially, Bitcoin’s future is uncertain. The next few days will be crucial in determining whether it can break out of its current range or continue to slide. The market’s waiting to see if bulls can regain control and turn resistance into support.