Bitcoin’s price has been swinging wildly lately, but some big investors aren’t worried. VanEck, a major investment firm, is sticking to its prediction that Bitcoin will hit $180,000 by the end of the year, even after a recent dip.

Big Money is Still Buying

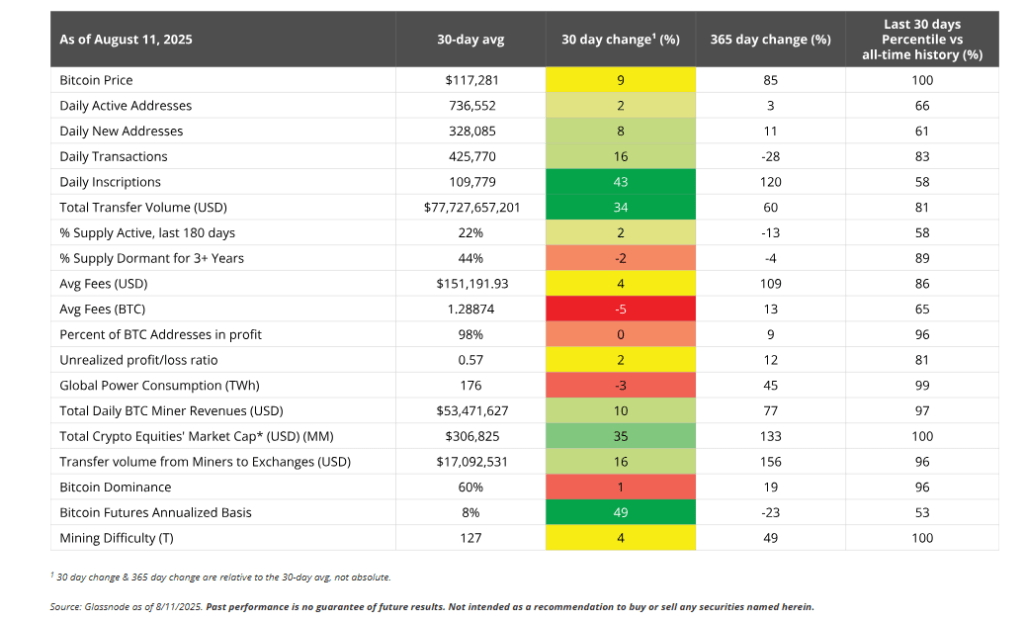

July saw a huge surge in institutional buying. Exchange-traded products snapped up 54,000 Bitcoin, while Digital Asset Treasuries added another 72,000. This shows that large investors are still piling into Bitcoin. VanEck made this $180,000 prediction back in November 2024 when Bitcoin was trading around $88,000. Interestingly, US-based Bitcoin miners now control 31% of the global mining power, up from 30% earlier this year, even as the overall stock market dipped.

Volatility and Quick Recoveries

Bitcoin briefly dropped to $112,000 in early August before bouncing back to $124,000 on August 13th – a new all-time high! Currently, it’s trading around $115,000. Many traders see this recent pullback as a normal correction after a big price increase, not a sign of a major crash.

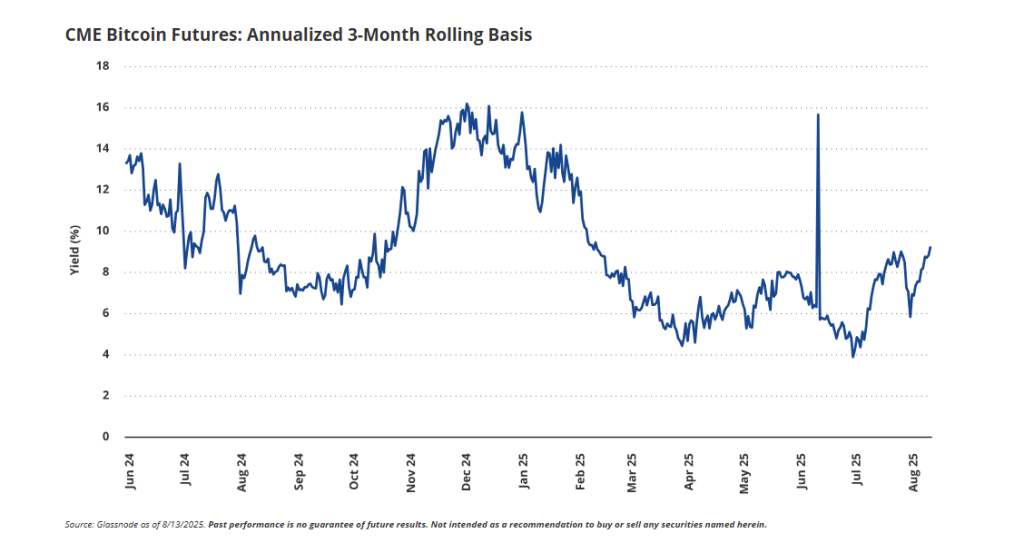

Speculative Frenzy?

Derivatives markets are showing signs of increased speculative interest. Funding rates are up, and options markets are heavily favoring bullish bets (calls over puts). This suggests that investors are betting big on Bitcoin going up. However, implied volatility is relatively low, making options cheaper to buy. While open interest in Bitcoin futures is high (over $6 billion), there has been a significant unwind recently.

Different Views on Bitcoin’s Future

There’s a lot of disagreement on just how high Bitcoin can go. Some prominent figures predict Bitcoin could reach $1 million by 2030, citing increased regulation and institutional adoption. Others are more cautious, suggesting that a million-dollar Bitcoin would likely be a sign of major economic trouble, not just market strength. Concerns have also been raised about how Wall Street’s growing influence might affect Bitcoin’s original purpose and community.

Key Support Levels

Technically, many analysts see the $100,000-$110,000 range as crucial support. A break below $112,000 could trigger further drops.

The Bottom Line

Right now, the Bitcoin market is a mixed bag. Strong institutional buying and speculative activity are pushing prices up, but cheap options and relatively low volatility make bullish bets less risky. Whether Bitcoin reaches VanEck’s $180,000 target will depend on whether this buying continues and whether key support levels hold.