Trading Activity Takes a Nap

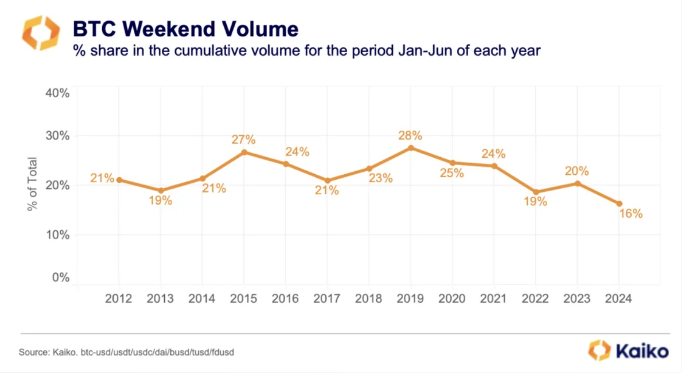

Bitcoin, known for its 24/7 accessibility, has seen a dramatic decline in weekend trading volumes. According to Kaiko, these volumes have dropped from 28% in 2019 to a mere 16% in 2024.

Institutional Influence

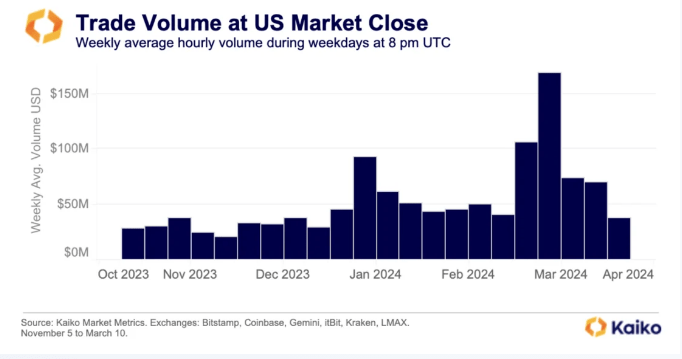

This decline coincides with the launch of spot Bitcoin ETFs in the US, which can only be traded during traditional market hours. Institutional investors, who favor these regulated products, are now influencing Bitcoin’s trading patterns, prioritizing weekdays over weekends.

Market Transformation Beyond Weekends

The decline in weekend activity is not just due to ETFs. The closure of crypto-friendly banks like Signature and Silicon Valley Bank has also contributed, as they provided infrastructure for market makers to place buy and sell orders around the clock.

Glimmer of Hope for Stability

Despite the reduced weekend activity, the report suggests that Bitcoin could become a more predictable asset, potentially attracting more institutional interest. Historically, July has been a positive month for Bitcoin, with price increases observed in seven out of the past 11 Julys.

Jitters on the Horizon

While weekend trading may be slowing down, the coming weeks could be turbulent for the crypto market. The potential approval of Ethereum ETFs could further fuel institutional involvement and impact Bitcoin’s dominance.

The Road Ahead

The dwindling weekend trading activity signals a potential shift in the Bitcoin market. Institutional investors are now shaping trading patterns, leading to a potential era of greater stability. However, this month could still bring significant volatility, keeping investors on their toes.