Bitcoin is hanging around the $62,000 mark, pretty much stuck in the same spot for the past day. It’s been in a holding pattern since its small gains last Friday. While many investors are expecting a big jump in price by the end of 2024, there are a few things that need to happen first.

Market Indicators Show a Bit of Nervousness

A Bitcoin analyst named burakkesmeci is watching some key market indicators closely. He says they show that investors are waiting for something big to happen.

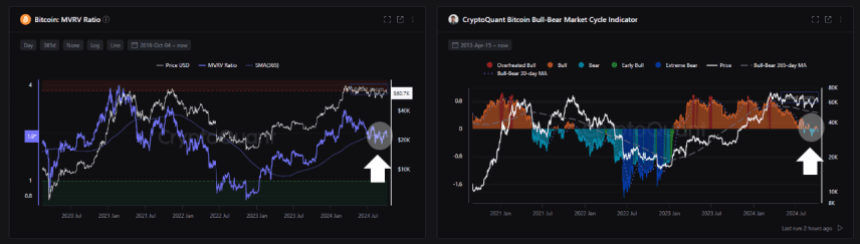

One indicator, the MVRV Ratio, compares Bitcoin’s current price to its historical price. It’s basically a way to see if Bitcoin is undervalued or overvalued. When the MVRV Ratio goes above a certain point, it usually means investors are making money and things are looking good. But right now, the MVRV Ratio is just below that point, which means Bitcoin is stuck in a holding pattern.

Another indicator, the CQ Bull & Bear metric, looks at recent price changes compared to long-term trends. This indicator is also showing that Bitcoin is in a holding pattern, with no clear direction.

What Could Spark a Bitcoin Rally?

burakkesmeci thinks a few things need to happen before Bitcoin breaks out of its holding pattern and starts going up.

- Lower Interest Rates: The Federal Reserve needs to keep lowering interest rates. This would make it easier for people to borrow money and invest in things like Bitcoin.

- More Money in the Economy: The US government needs to inject more money into the economy. This would give people more money to spend, and some of that money might flow into Bitcoin.

Right now, Bitcoin is down slightly for the day, but its trading volume is also way down. This shows that investors are holding onto their Bitcoin and waiting to see what happens next.