Crypto analyst Tony “The Bull” Severino recently shared his insights on Bitcoin’s price history, focusing on its cyclical nature. He believes understanding these cycles is key to navigating the crypto market’s ups and downs.

Bitcoin’s Four-Year Rhythm

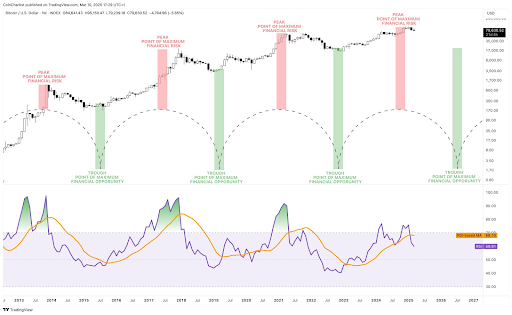

Severino’s analysis centers on Bitcoin’s roughly four-year cycles, largely tied to its halving events. He uses a monthly chart going back to 2013, identifying four distinct cycles. Each cycle, viewed from “trough to trough,” shows a pattern:

- Troughs: These are market lows, but also represent great buying opportunities.

- Crests:

These are market highs, representing maximum risk. Severino marks these crests in red on his chart.

These are market highs, representing maximum risk. Severino marks these crests in red on his chart.

The Current Cycle: Crest Passed, But Top Not Confirmed?

Bitcoin hit its all-time high of $108,786 in January 2025, seemingly passing its current cycle’s crest. Since then, it’s corrected, dropping as low as $78,780 in early March. This drop has sparked debate about whether Bitcoin has already peaked this cycle.

However, Severino notes that past cycles haven’t always seen immediate reversals after the crest. Sometimes, the price continues to rise for a while (“right-translated peaks”). The 2017 bull run is a prime example.

Navigating the Narrowing Window

While Bitcoin appears to have passed the crest in Severino’s model, it doesn’t automatically mean a market top is in. The risk of a bearish phase increases the longer the correction continues. At the time of writing, Bitcoin is showing signs of recovery, but the margin for error is shrinking. Other analysts believe further price increases are possible before a definitive top is reached.