Kazancını artırmak isteyen oyuncular güvenilir casino siteleri fırsatlarını değerlendiriyor.

Adres sorunlarını çözmek için bahsegel her zaman tercih ediliyor.

Rulet, blackjack ve slot oyunlarını bettilt deneyimlemek için sayfasına giriş yapılmalı.

Canlı oyunlarda oyuncuların %64’ü haftada iki veya daha fazla kez oturum açmaktadır; bu, yüksek bağlılık oranını gösterir ve bahsegel giriş ’te de gözlemlenir.

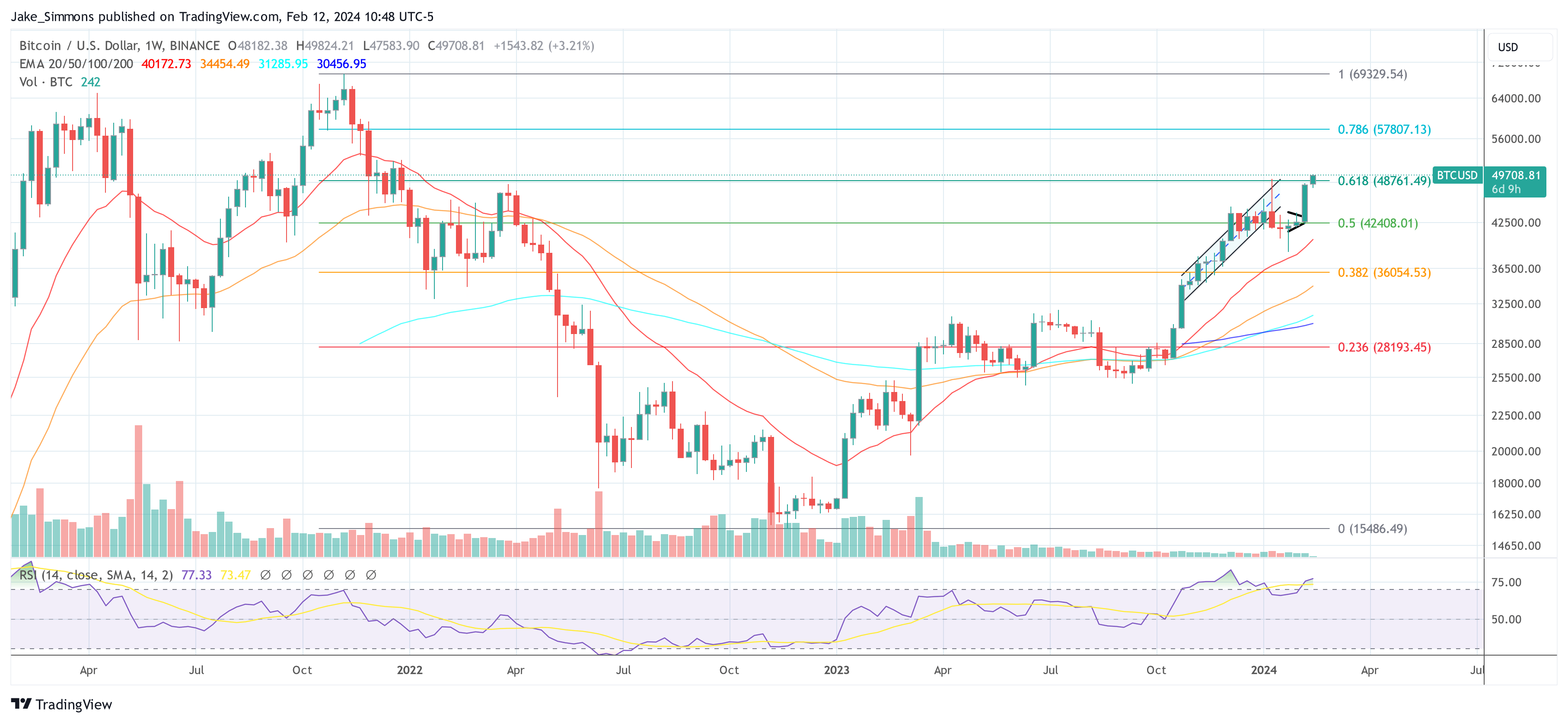

Halvings: A Key Event in Bitcoin’s Ecosystem

Halvings, which occur every four years, reduce the reward for mining Bitcoin transactions by half.

This event maintains Bitcoin’s scarcity and disinflationary profile, making it appealing to investors.

However, price surges post-halving are not guaranteed, as investors may anticipate and buy in advance.

Distinguishing Factors of the 2024 Halving

Macroeconomic Factors

Macroeconomic factors have historically influenced Bitcoin’s price.

In 2012, the European debt crisis boosted Bitcoin’s value.

In 2016, the Initial Coin Offering boom indirectly benefited Bitcoin.

In 2020, the COVID-19 pandemic drove investors to Bitcoin as a hedge.

Miners’ Strategic Adjustments

Miners are selling their Bitcoin holdings to prepare for the reduction in block reward income.

This foresight suggests miners are actively preparing for the challenges ahead.

The Emergence of Ordinals and Layer 2 Solutions

Ordinal Inscriptions and Layer 2 solutions have expanded Bitcoin’s functionality and scalability.

Ordinals have generated significant transaction fees for miners.

Layer 2 solutions address Bitcoin’s scalability challenges.

The Role of ETF Flows

Spot Bitcoin ETFs have facilitated wider access for investors.

ETF flows could balance market dynamics post-halving by absorbing sell pressure.

A Promising Outlook for Bitcoin

Bitcoin has weathered the bear market and emerged stronger.

It is evolving into something more significant than digital gold.

The upcoming halving is expected to have a positive impact on Bitcoin’s price.

Post navigation