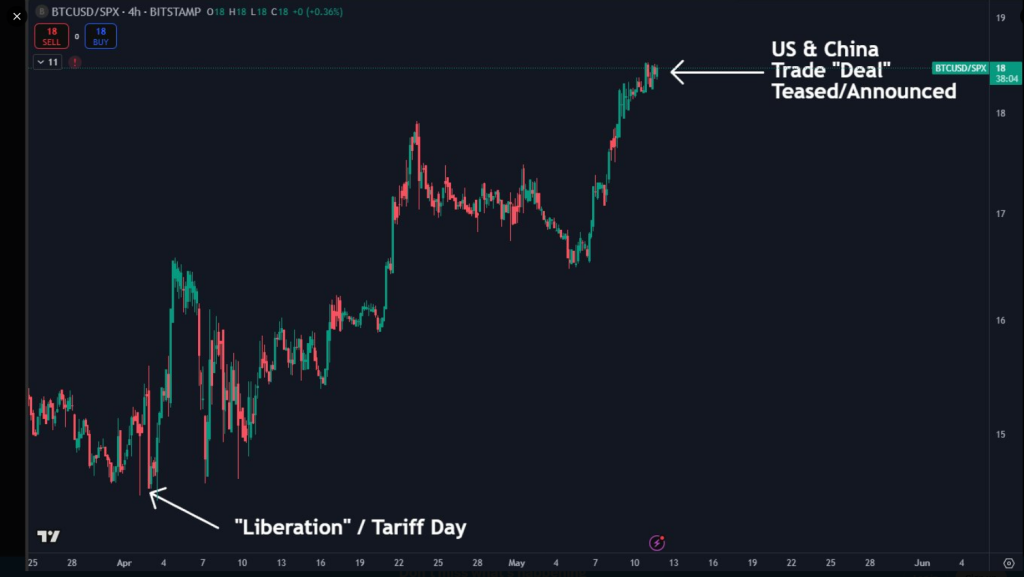

Bitcoin has been on a roll lately, climbing about 25% since early April, even as the stock market took a dip. This is pretty impressive considering the overall economic climate.

Bitcoin’s Resilience

While the S&P 500 dropped nearly 1% in April, Bitcoin actually went up. This happened even with all the worry about rising tariffs and trade tensions. Some people thought Bitcoin might be used to get around these tariffs, acting as a way to avoid fees on international trade. However, there’s no real evidence of this happening. Governments are pretty transparent about large transactions, and any attempts to use crypto for this purpose would likely be noticed by regulators.

Technical Analysis and Predictions

Technical analysts are watching Bitcoin closely as it approaches a key resistance level around $105,000. If it can’t break through, it might fall back to around $100,000. Some analysts see a potential “Inverse Head & Shoulders” pattern forming on the charts, which could signal further upward movement after a brief dip. However, the pattern isn’t fully formed yet, so it’s still too early to say for sure. There’s a chance we could see some altcoins gain attention before Bitcoin takes off again.

The Bigger Picture: Long-Term Outlook

Many investors are waiting to buy Bitcoin if it dips below the $105,000 mark. While dips offer good buying opportunities, Bitcoin’s strong runs tend to last for months, not just days.

There are still some risks to consider, such as potential interest rate hikes, stricter crypto regulations, and new cryptocurrencies entering the market. However, positive factors like increasing ETF flows and strong investor holdings offer some reassurance. Plus, any positive developments in US-China trade negotiations could ease some market tension.

Ultimately, Bitcoin’s price is influenced by more than just global tariffs. Monetary policy, large institutional investors, and overall market sentiment all play a significant role. If Bitcoin continues to outperform stocks, it could cement its position as a serious alternative asset in the global market. For now, all eyes are on those crucial price levels around $105,000.