Analyst Ali Martinez is seeing a unique signal for Bitcoin (BTC), suggesting a potential price surge. He’s noticed a disconnect between Bitcoin’s price and rising global liquidity, which historically has been a strong indicator for Bitcoin bull runs.

Bitcoin Lagging Behind Liquidity

Global liquidity, a measure of available money in the financial system, has been increasing since Q3 2024. However, Bitcoin’s price has remained relatively flat during this period. Martinez believes this divergence could be a prime buying opportunity. He points out that Bitcoin usually moves in line with global liquidity increases, so this lag is unusual.

A Key Price Level to Watch

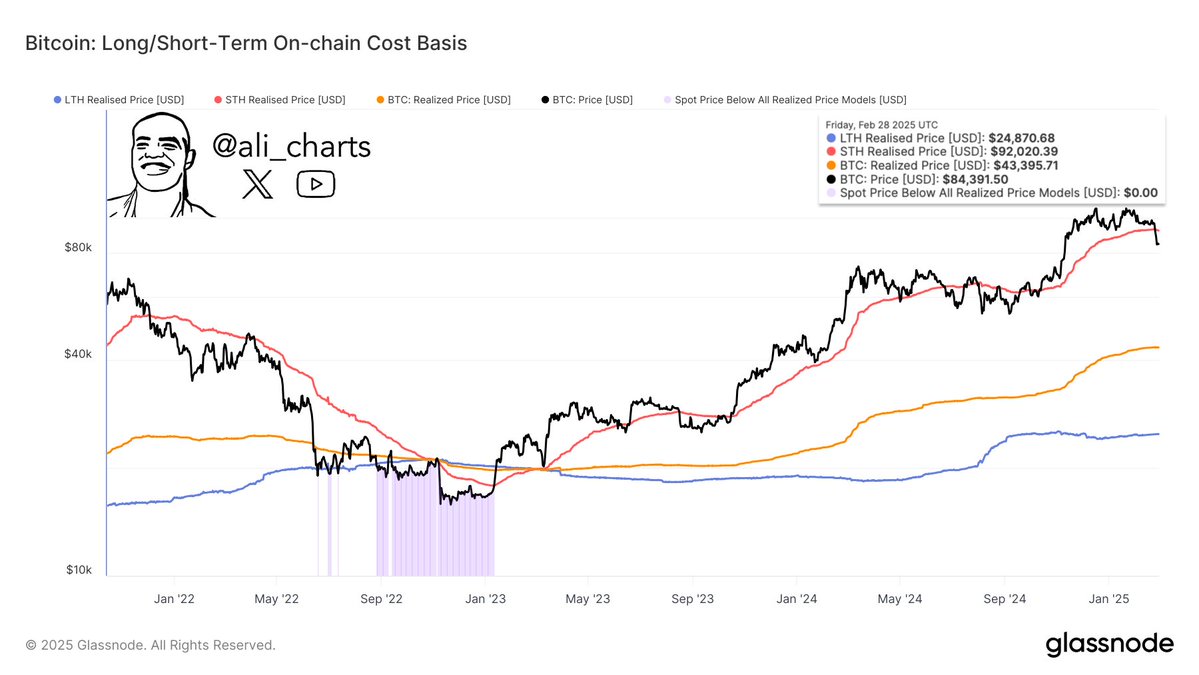

Martinez highlights a crucial price point for Bitcoin to continue its upward trend: the short-term holder realized price. This metric represents the average price at which investors who’ve held Bitcoin for less than 155 days bought their coins. Currently, this price sits around $92,000. If Bitcoin can reclaim this level, Martinez believes it could signal a significant bull run.

Current Bitcoin Price and Disclaimer

At the time of writing, Bitcoin is trading at approximately $92,670, just slightly above this key level. It’s important to remember that this analysis is just one perspective, and investing in cryptocurrency carries significant risk. Always do your own research before making any investment decisions.