Bitcoin’s supply is getting squeezed, and it’s happening fast. Demand from US Bitcoin ETFs is way higher than anyone expected, creating a serious imbalance between how much Bitcoin is being bought and how much is being mined.

ETF Buying Spree: A Supply Shock in the Making?

In December 2024, the story was shocking. US Bitcoin ETFs bought a whopping 51,500 Bitcoin. That’s almost four times the 13,850 Bitcoin miners produced that same month! This means ETFs alone bought up over 272% more Bitcoin than was mined.

Crypto analyst Lark Davis called it a “massive supply shock” and he wasn’t wrong. He pointed out that at one point in December, ETFs bought 21,423 Bitcoin while miners only produced 3,150. By December 17th, ETFs globally held a staggering 1,311,579 Bitcoin – that’s $139 billion, or 6.24% of the total Bitcoin supply! Davis predicts that during a major bull market, ETFs could hold 10-20% of all Bitcoin, making a supply shock even more likely.

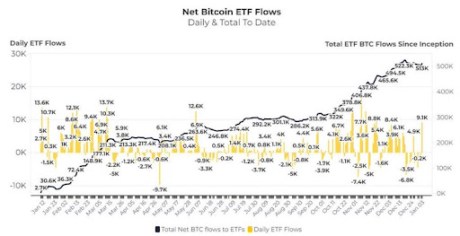

December’s Wild Ride: Inflows and Outflows

Data from Glassnode shows just how dramatic December was. Bitcoin ETF inflows hit $4.63 billion, nearly double the 2024 monthly average of $2.77 billion. Most of this happened early in the month, with outflows later on (except for December 26th). This perfectly mirrors Bitcoin’s price: a huge price surge to a new all-time high above $108,000 on December 17th, followed by a drop as ETF outflows increased.

The Buying Continues

But the buying frenzy didn’t stop in December. Early in January 2025, investors poured over $900 million into Bitcoin ETFs. More recently, another 9,500 Bitcoin (over $966 million) were added to ETF holdings. The pressure on Bitcoin’s supply is clearly continuing.