Bitcoin’s feeling pretty good these days, but investors aren’t jumping on the hype train just yet.

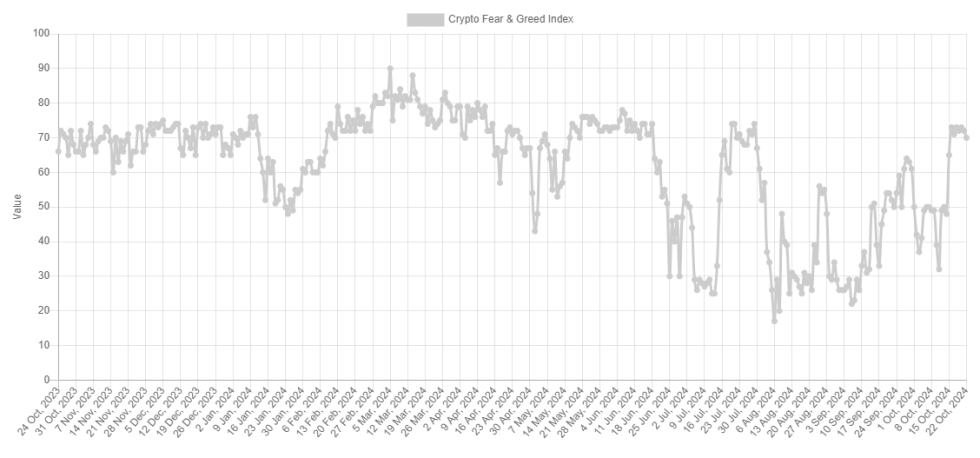

The Fear & Greed Index, which measures investor sentiment in the crypto world, is currently sitting at 70, indicating a “greedy” market. This means most people are feeling optimistic about Bitcoin.

How does the index work?

It’s based on five factors:

- Volatility: How much the price is jumping around.

- Trading volume: How much Bitcoin is being bought and sold.

- Social media sentiment: What people are saying about Bitcoin online.

- Market cap dominance: Bitcoin’s share of the total crypto market.

- Google Trends:

How much people are searching for Bitcoin online.

How much people are searching for Bitcoin online.

A “greedy” market isn’t necessarily a bad thing. It means people are bullish on Bitcoin and are willing to invest. However, the index hasn’t reached “extreme greed” territory (75 or above), which is usually seen at the peak of a bull market.

The fact that investors haven’t gone completely crazy about Bitcoin could be a good thing. It suggests that the rally still has some legs and hasn’t reached its peak yet.

Bitcoin’s price has been on a roll lately, but it’s recently pulled back a bit. It’s currently trading around $67,300 after hitting a high of over $69,000 a few days ago.

Overall, the market is feeling pretty good about Bitcoin, but investors are still cautious. This could be a sign that the rally still has room to run. /p>