Bitcoin’s price has dipped below the $100,000 mark and is currently hanging out between $96,000 and $98,000. Let’s explore why.

Strong Support Levels

Crypto analyst Ali Martinez points to a key support level between $95,830 and $98,830. A significant number of investors bought Bitcoin around this price, and they’re holding on, preventing a bigger price drop. This group’s continued support is crucial; a major sell-off could easily push Bitcoin below $90,000.

The Fed’s Influence and Investor Sentiment

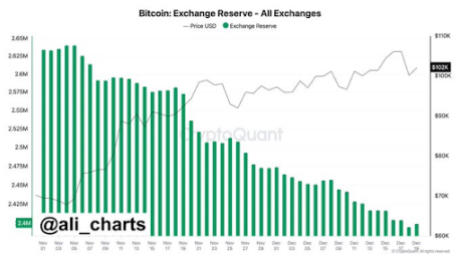

The recent price drop below $100,000 followed Federal Reserve Chair Jerome Powell’s comments hinting at a more aggressive approach to interest rates. This generally creates a negative outlook for riskier assets like Bitcoin, triggering selling. However, the good news is that most Bitcoin holders are still in profit (86% according to IntoTheBlock data), suggesting continued bullish sentiment. Furthermore, a significant amount of Bitcoin (74,052 BTC in December alone) has been withdrawn from exchanges, indicating investors are holding rather than selling.

Traders Eyeing a Reversal

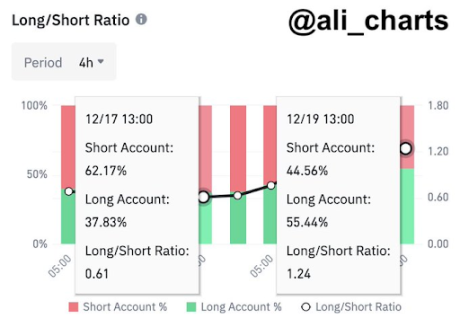

Many traders are anticipating a price increase. Martinez notes that Binance traders initially bet heavily against Bitcoin at $108,000. Now, the sentiment has shifted, with many expecting a price bounce from below $96,000.

Crucial Support and Potential Future Price Movements

Holding the $96,000 support is vital. Breaking below it could trigger a fall to $90,000 or even $85,000, according to Fibonacci analysis. On the other hand, some analysts, like Justin Bennett, still see $110,000 as a potential target.

Current Price and Conclusion

At the time of writing, Bitcoin is trading around $97,000, down slightly over the last 24 hours. The price’s current stability is largely due to strong support from investors who bought around the $96,000-$98,000 range. Whether it breaks through to new highs or falls further remains to be seen.