Samson Mow, a crypto project founder, believes that the recent stability in Bitcoin’s price can be attributed to the launch of spot Bitcoin exchange-traded funds (ETFs) in the United States.

Spot ETFs’ Impact on Bitcoin’s Price

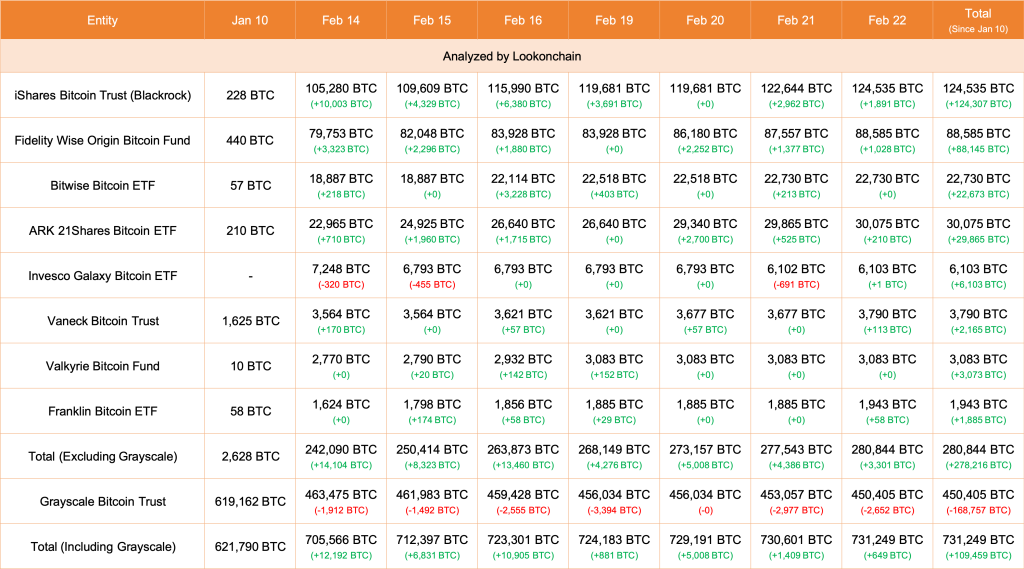

Mow argues that without the capital influx from spot Bitcoin ETFs, the cryptocurrency would have experienced a significant price drop, potentially falling below $40,000. The introduction of these ETFs has injected billions of dollars into the Bitcoin market, increasing its liquidity and preventing a major price decline.

Liquidity and Volatility

Liquidity and volatility are closely related, especially in the crypto and Bitcoin markets. Generally, higher liquidity, represented by more buyers and sellers, leads to increased circulating capital and reduced volatility.

Since the launch of spot Bitcoin ETFs, billions of dollars have entered the market, enhancing Bitcoin’s liquidity. This increased liquidity has contributed to Bitcoin’s stability, making it more attractive to institutional investors who seek stability in their investments.

Bitcoin’s Price Action and Future Outlook

Currently, Bitcoin is trading within a tight range but maintains a bullish outlook. After briefly retesting $53,000, the coin experienced a slight correction but found support around $50,500. Analysts believe that if the uptrend continues, Bitcoin is likely to break above $53,000 and potentially reach $70,000.

The upcoming Bitcoin halving is also seen as a potential catalyst for price appreciation, although its impact remains uncertain. Despite its increasing liquidity, Bitcoin is still a relatively new asset class, and the global market is still adapting to its presence. As more institutions diversify their portfolios, Bitcoin is likely to gain wider adoption.