Bitcoin’s price hasn’t been skyrocketing as some expected. Why? It turns out, some big players – what analysts call “whales” – are influencing the market in significant ways.

OG Whales and Their Deep Pockets

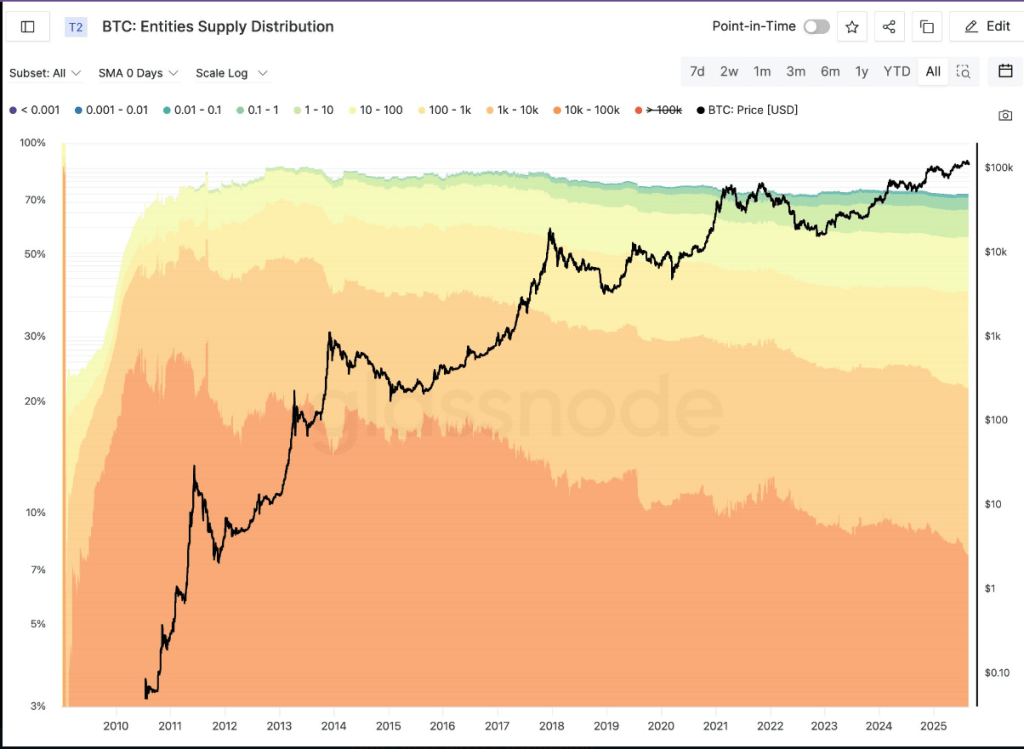

Early Bitcoin adopters, who bought in back around 2011 when Bitcoin was worth about $10, now hold a massive amount of Bitcoin. Analyst Willy Woo points out that these “OG” whales have a huge cost basis advantage. It takes over $110,000 of new money to buy one Bitcoin from them, making it tough for the market to absorb large sell-offs. This explains the relatively slow price increases despite growing overall market interest.

A Whale’s Quick Move and Market Impact

Recently, a single whale’s actions caused a significant price drop. They moved a large amount of Bitcoin (around 24,000 BTC, or $2.7 billion) into Ether (ETH). This swift transfer triggered a sell-off, briefly wiping roughly $45 billion off Bitcoin’s market cap. Bitcoin dropped from $114,500 to $112,050 in just nine minutes! Ether also took a hit, falling 3.8%. Prices did partially recover later.

The Whale’s Strategy: Leverage and Long Positions

Analysis suggests this whale converted much of their Bitcoin into Ether, even staking a large portion. They also took on substantial leveraged long positions in Ether on the Hyperliquid platform, further influencing the market. This strategy resulted in a substantial profit of around $185 million for the whale. However, the subsequent closing of these positions contributed to the rapid price reversals and cascading sell-offs.

Two Sides of the Coin: Dormant and Active Whales

The situation highlights two key market forces:

- Long-dormant whales: These are the OG holders with massive unrealized gains, potentially holding hundreds of thousands of Bitcoin. Their future actions could significantly impact the market.

- Active traders:

Whales who actively trade, using large-scale rotations to profit from short-term price swings.

The whale in question still holds a substantial amount of Bitcoin, leaving the possibility of further market impact. However, the large amount of ETH staked suggests at least some whales are taking a longer-term view. The future price of Bitcoin will likely depend on the actions of these powerful players.