Bitcoin recently bounced back a bit after a price drop in late December 2024. Let’s look at what short-term holders (STHs) are doing and what it might mean for Bitcoin’s price.

Short-Term Holders are Making a Profit

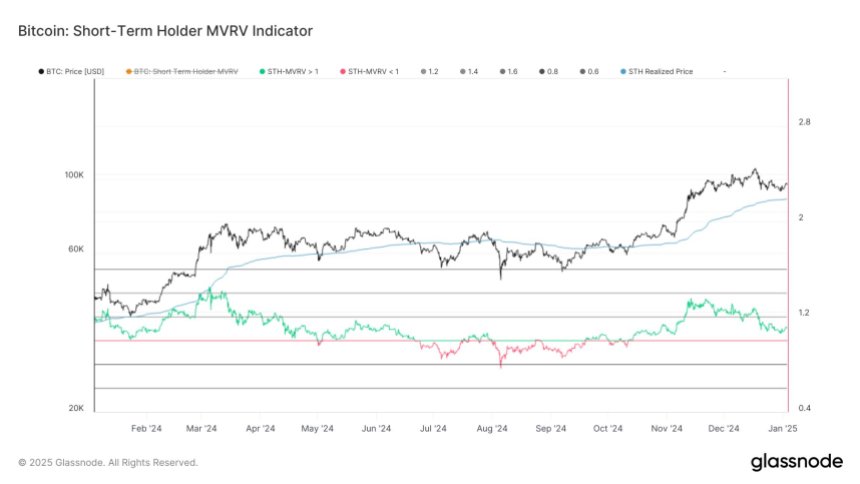

A recent report from Glassnode showed that Bitcoin’s short-term holder Market Value to Realized Value (MVRV) ratio is currently 1.1. This means STHs (those who bought Bitcoin in the last 155 days) are averaging a 10% profit.

The MVRV ratio is a useful tool to see if an asset is over or undervalued. A ratio above 1 means profit, below 1 means a loss.

Will STHs Cash In Their Profits?

This profit might lead to some selling, putting pressure on the price. However, Glassnode points out that the MVRV ratio for STHs has been higher before (1.35 in November 2024 and 1.44 in March 2024). This suggests STHs might hold on even if profits increase further. If demand stays strong and the price keeps rising, we could see the MVRV ratio approach those previous highs, which could be a positive sign for Bitcoin.

A Crucial Support Level for Bitcoin

The MVRV ratio of 1.0 (break-even point) is important. Glassnode’s data shows this corresponds to a Bitcoin price of around $87,000. There’s a notable lack of buying activity between $87,000 and $71,000. If Bitcoin falls below $87,000, there’s not much support until $71,000, which could cause a significant price drop.

At the time of writing, Bitcoin is trading above $98,000. It’s still the biggest cryptocurrency by market cap.