Exodus from Bitcoin

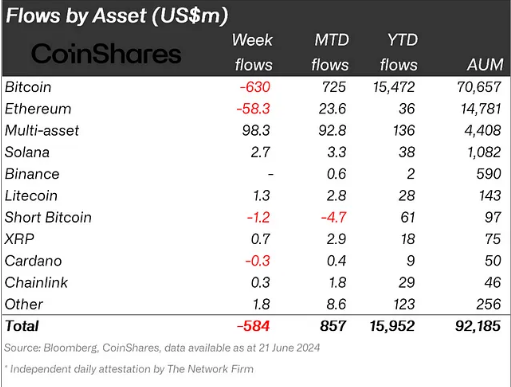

Bitcoin, the crypto king, has been taking a beating. Investors are fleeing in droves, spooked by the prolonged price slump. Last week alone, a whopping $630 million exited Bitcoin, according to CoinShares. This follows a similar outflow of $631 million the week before.

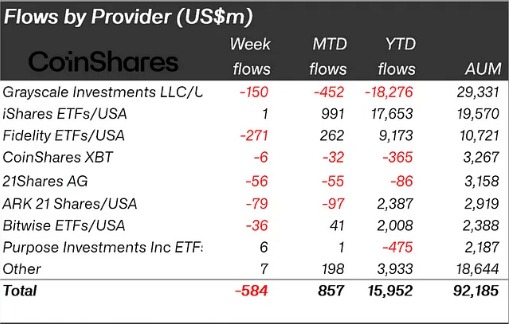

The sell-off extends to Bitcoin exchange-traded funds (ETFs), which allow investors to trade crypto without owning it directly. Major issuers like Fidelity and Grayscale have seen hundreds of millions of dollars vanish from their coffers.

Glimmers of Hope

Amidst the gloom, there are a few bright spots. Short positions, which bet on a price decrease, have declined. This suggests a potential shift in investor sentiment.

Some altcoins, such as Solana, Litecoin, and Polygon, have bucked the trend and posted gains. This shows that not all bets are off the table, and some investors may be looking for opportunities elsewhere in the crypto market.

Crypto Winter or Avalanche?

The crypto market is known for its volatility. Bitcoin has experienced boom-and-bust cycles before. However, the current downturn raises concerns about a prolonged “crypto winter.”

The approval of an Ethereum ETF, once seen as a potential catalyst, has failed to lift spirits. It remains to be seen whether investors will regain their appetite for digital assets or if the current outflow will snowball into a full-blown avalanche.