The Fed’s Interest Rate Cut: A Potential Catalyst for Bitcoin?

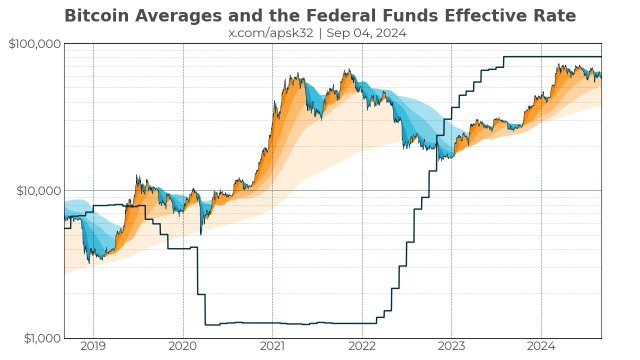

With the Federal Reserve (Fed) getting ready to cut interest rates, everyone’s talking about what this could mean for Bitcoin. One crypto expert, Apsk32, thinks Bitcoin might act like it did back in 2019 after the Fed cut rates then.

A Peek into the Past: 2019’s Bitcoin Rollercoaster

Apsk32 remembers what happened in 2019. When the Fed cut rates, Bitcoin surged about 20% in a week. But, a few months later, it crashed over 33%, leaving many disappointed.

Apsk32’s Prediction: A Similar Pattern in 2024?

Apsk32 believes that if the Fed cuts rates this year, Bitcoin could follow a similar pattern. He thinks it might jump initially but then could fall again, although he doesn’t think it will crash as hard as it did in 2019.

A Long-Term Vision: Bitcoin’s Potential for Growth

Apsk32 is a big believer in Bitcoin’s long-term potential. He’s even predicted that Bitcoin could reach $2.6 million in the future. He bases this on a pattern he’s seen in Bitcoin’s market cap since 2011.

More Bullish Predictions: A Bright Future for Bitcoin?

Apsk32 isn’t the only one with a positive outlook on Bitcoin. VanEck, a big asset management company, has also predicted that Bitcoin could reach $2.9 million by 2050. They think Bitcoin could become a major player in international and domestic trade, leading central banks to hold a significant portion of their assets in Bitcoin.

The Bottom Line: A Rollercoaster Ride with Potential for Growth

So, what does this all mean? It seems like Bitcoin could be in for a wild ride in the near future, potentially mirroring the ups and downs of 2019. But, experts like Apsk32 and VanEck believe that Bitcoin has a bright future and could reach incredible heights in the long run.