Bitcoin has been on a wild ride lately, hovering around $87,000. Investors are anxiously waiting for the coin to hit $90,000, but a big announcement could shake things up.

Inflation Report: A Big Deal for Bitcoin

The Consumer Price Index (CPI) report, which measures inflation, is due out today. This report is a big deal for Bitcoin because it can influence the Federal Reserve’s decisions on interest rates.

Here’s why:

- Lower inflation = Lower interest rates: This could be good news for Bitcoin. Lower interest rates often encourage people to invest in riskier assets like cryptocurrencies, boosting demand for Bitcoin.

- Higher inflation = Higher interest rates: This could be bad news for Bitcoin. Higher interest rates make it more expensive to borrow money, which could discourage people from investing in crypto.

Expert Predictions: A Potential 10% Drop

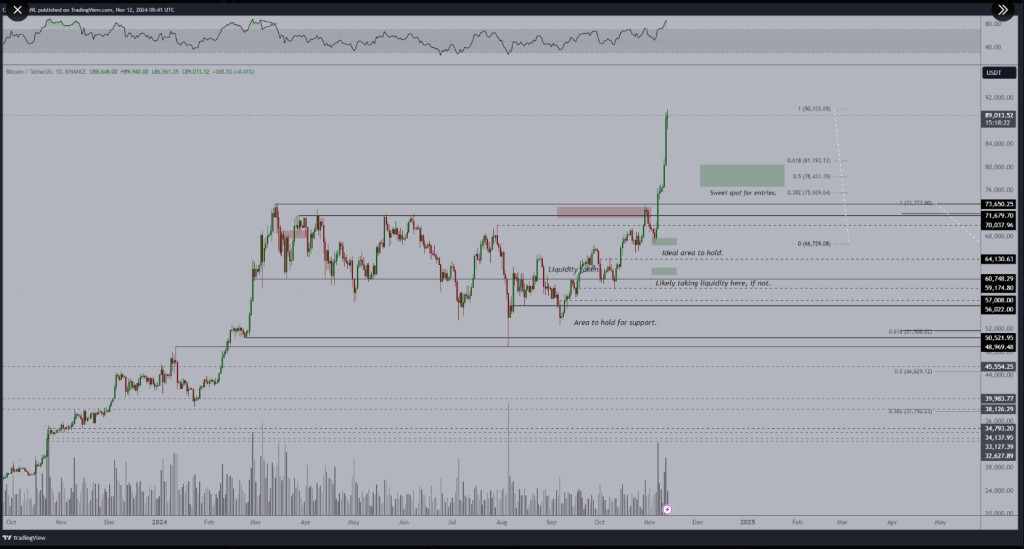

Crypto expert Michaël van de Poppe believes that the CPI report could cause a 10% drop in Bitcoin’s price. He expects Bitcoin to fall to between $75,660 and $81,193 before the report is released.

Market Uncertainty: A Mixed Bag of Opinions

The market is buzzing with speculation about what the CPI report will mean for Bitcoin. Some experts think it could lead to a price surge, while others are more cautious.

Here’s the bottom line:

- The CPI report is a major event that could have a big impact on Bitcoin’s price.

- Investors should be prepared for volatility and proceed with caution.

- The long-term outlook for Bitcoin remains positive, but the short-term future is uncertain.