Bitcoin started 2025 with a bang, briefly topping $100,000 for the first time in weeks. But this rally wasn’t without its caveats.

A Dip Below Six Figures

After hitting a high of $102,760, Bitcoin experienced a correction, falling back below the $100,000 mark. At the time of writing, it’s trading between $96,000 and $102,000, with a daily trading volume of $6.58 billion. While this price action might seem healthy, a closer look reveals a more cautious market sentiment.

Funding Rates Tell a Different Story

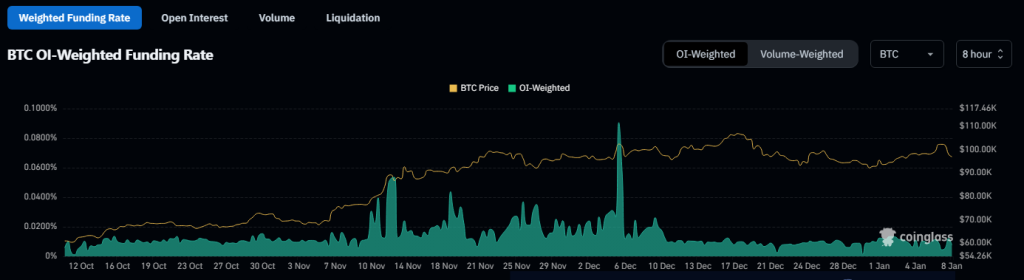

The average funding rate, a key indicator of market sentiment, is painting a different picture. It’s dropped to 0.009%, below the neutral level of 0.01%. This low rate suggests investors are hesitant to take on significant long positions, indicating a lack of strong bullish conviction. The weekly moving average has also cooled significantly from its mid-December peak. Several sources, including Glassnode, show a similar trend of declining funding rates, further supporting this cautious outlook.

Is This Rally Sustainable?

Several metrics paint a mixed picture. While some indicators like Open Interest-Weighted and Volume-Weighted Funding Rates showed slight increases, they remained well below recent highs. This reinforces the idea that many traders are wary of Bitcoin’s ability to maintain its recent price gains. Their reluctance to leverage their positions speaks volumes about their uncertainty.

What Lies Ahead?

Despite the cautious sentiment reflected in funding rates, there’s some positive news. Derivatives trading activity has increased significantly, with daily volume surging by 42% to $85 billion. Open interest also saw a modest uptick, and the Long/Short ratio is near neutral. The Chande Momentum Index (CMI) also showed some strength during the initial price surge but cooled as the price retreated.

In short, while Bitcoin’s price action has been exciting, underlying market data suggests a degree of caution. Whether this rally is sustainable remains to be seen.