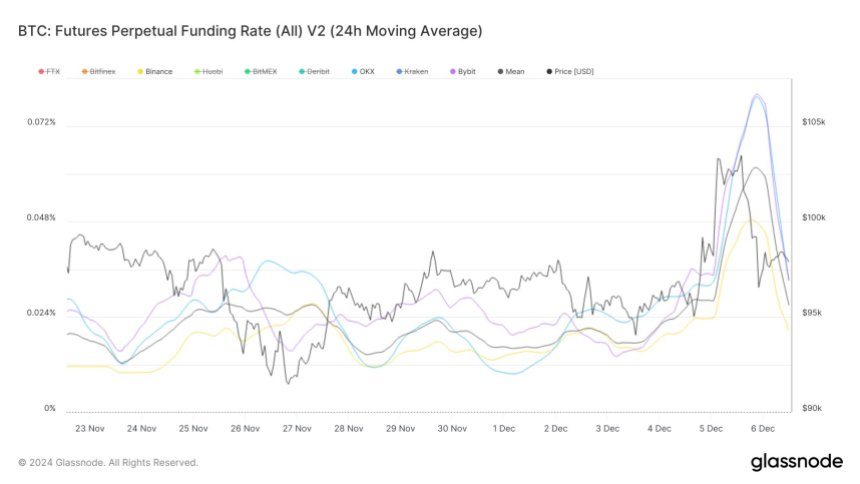

Bitcoin took a wild ride last week. After briefly hitting $100,000, it crashed 7% on Friday. While this drop impacted funding rates in the derivatives market, high leverage remains, suggesting more volatility ahead.

Funding Rates and the Short-Term Outlook

What are funding rates? Basically, they’re payments between traders in the futures market to keep the contract price in line with Bitcoin’s actual price. Positive rates mean long-term bettors (those expecting the price to go up) are paying short-term bettors (expecting a price drop). Negative rates are the opposite.

Glassnode, a blockchain analytics firm, noticed something interesting. Bitcoin’s funding rates initially stabilized, but then surged 3.6 times their weekly average when the price hit $100,000. This happened because of increased market leverage – more people were betting big. The peak funding rate was the highest since April! This shows how much the derivatives market influenced Bitcoin’s climb to $100,000.

The crash brought funding rates down, but they’re still relatively high. This means lots of leveraged positions are still out there, setting the stage for potential volatility. A price swing either way could trigger a wave of liquidations (people being forced to sell), causing a domino effect.

A $112,000 Price Prediction?

Analyst Ali Martinez has a prediction based on the cost basis of short-term Bitcoin holders (STH). This is the average price they paid for their Bitcoin over the last 155 days. Martinez suggests a potential price target of $112,926, based on the STH cost basis and typical market behavior.

At the time of writing, Bitcoin is trading around $100,137 after recovering somewhat from Friday’s crash, but it faced resistance at $102,000. Trading volume is down significantly.