Bitcoin’s price took a wild ride this week, dipping below $100,000 before bouncing back above $107,000. But despite this recovery, a new trend is emerging that could impact Bitcoin’s future.

A Surge in Short Positions

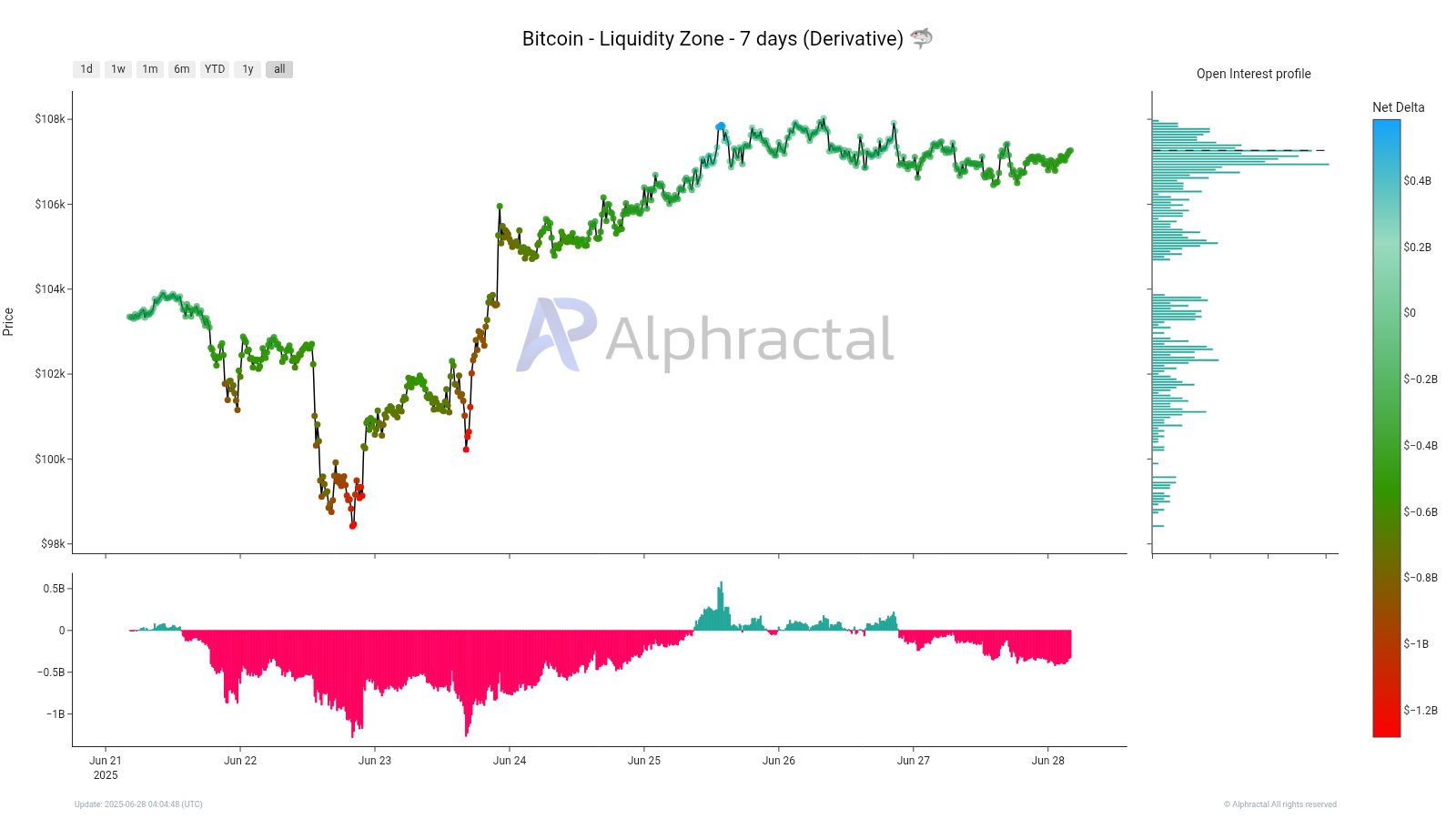

A recent analysis from Alphractal highlighted a significant increase in short positions over the past seven days. This means more people are betting against Bitcoin’s price. They’re essentially hoping the price will fall so they can profit.

Alphractal used a “Liquidity Zone (7 Days)” indicator which tracks three key things: Bitcoin’s price movement, the net difference between long (buy) and short (sell) positions (called “Net Delta”), and the distribution of these positions at different price levels. A positive Net Delta means more buyers, while a negative Net Delta (like the one observed) indicates more sellers.

The chart showed a significant negative Net Delta, clearly showing a dominance of short positions.

The Bear Trap?

Interestingly, this doesn’t automatically mean a price crash is imminent. The high number of short positions occurred while Bitcoin’s price remained relatively stable, even slightly increasing. This suggests the bears might be caught in a trap.

If Bitcoin breaks through the current resistance and continues to rise, a “short squeeze” could occur. This is where short sellers are forced to buy back Bitcoin at higher prices to limit their losses, further pushing the price up.

What’s Next for Bitcoin?

The future remains uncertain. While Bitcoin is currently trading around $107,309, its recent growth is modest (0.2% in the last 24 hours, compared to 5.2% over the past seven days). Alphractal cautions those betting against Bitcoin to proceed with caution. The market is currently showing choppy trading patterns, and the next move could go either way.