Bitcoin’s price has been a wild ride lately. After hitting almost $107,000, it’s tumbled down to around $94,550. So, what’s the deal? Is this just a temporary dip, or is a bigger correction on the way?

Is $92,000 the Floor?

CryptoQuant analyst Shayan thinks the $92,000 mark is a crucial support level for Bitcoin. If it breaks below that, we could see a wave of selling, potentially pushing the price down towards the 100-day moving average of around $81,000. However, he also points out that this level has historically attracted buyers and acted as support in the past. Other significant support levels are around $90,000 and Fibonacci retracement levels at $87,000 and $82,000. A break below these could mean more selling pressure.

A Bullish Prediction?

Despite the bearish vibes, analyst Crypto Rover is feeling optimistic. He’s seeing historical patterns that suggest January could be good for Bitcoin. He even tweeted that Bitcoin’s price history is repeating itself and predicts a price increase. He believes a break above $100,000 could send Bitcoin soaring past $107,000.

Big Money is Watching

Adding to the bullish sentiment, Bitcoin ETFs have seen massive inflows – over $900 million – from big players like BlackRock and Fidelity. This shows that institutions are still pretty confident in Bitcoin’s long-term prospects. However, Rover cautions that if Bitcoin fails to stay above $100,000, a drop back to $92,000 or lower is possible.

The Broader Crypto Market is Feeling the Pinch

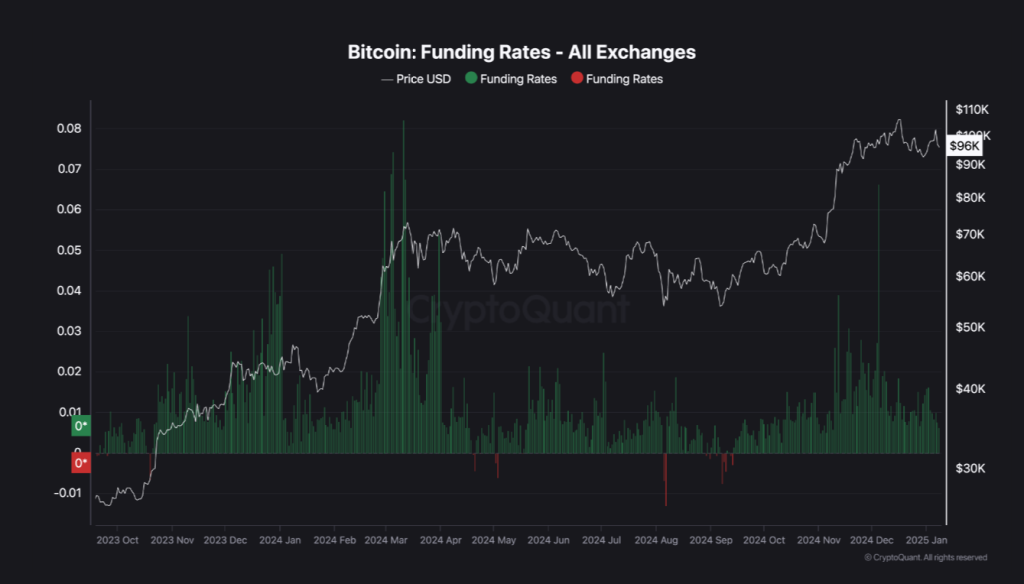

The whole crypto market is feeling the pressure. Ether, Solana, and other cryptos are down significantly. Even traditional crypto stocks like MicroStrategy and Coinbase have taken a hit. Falling funding rates in the derivatives market add to the bearish feeling, indicating less demand for Bitcoin derivatives. This, according to Shayan, plays a big role in price movements.