Bitcoin’s price dipped slightly last week, but experts remain optimistic about its future. One analyst, Percival from CryptoQuant, predicts a massive price surge.

The $150,000 Prediction

Percival believes Bitcoin will hit $150,000 during this bull market cycle. He points out that Bitcoin’s price movements—sharp rises followed by periods of stability—are typical of established financial assets.

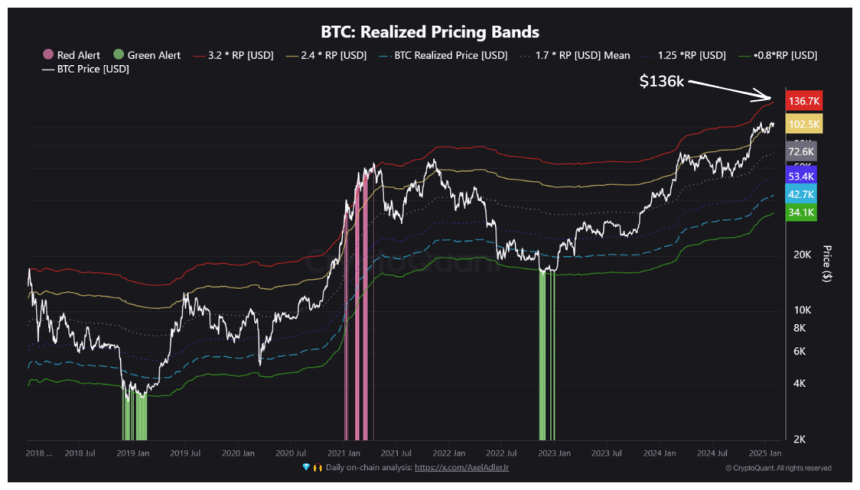

His prediction is based on a Fibonacci expansion analysis, using Bitcoin’s low of $15,450 in November 2022 and its consolidation around $48,934 in 2024. This analysis suggests a price target between $136,000 and $150,000. This is further supported by data from Bitcoin Realized Price Bands, which looks at how much Bitcoin was bought at different prices.

Reaching $150,000 would require a $3 trillion market cap for Bitcoin. Percival argues this is achievable based on historical data. The Bitcoin Realized Cap increased by 470% during the previous bear market, while the current increase is only 111%, indicating significant room for growth.

Fueling the Growth: Demand Drivers

Several factors could drive this market expansion:

- US Bitcoin Spot ETFs: These funds saw nearly $40 billion in inflows during their first year (2024), and further growth is expected, especially with a pro-crypto stance from the US government.

- Bitcoin Futures Market: The current $95 billion market represents another potential source of bullish momentum.

Current Market Conditions and Future Outlook

Currently, Bitcoin is trading around $102,334 (at the time of writing), down slightly for the day but up significantly for the month. Investor sentiment is extremely bullish, according to the Fear & Greed Index (76).

Other analysts at CoinCodex predict Bitcoin will reach $113,658 in five days and $132,823 in 30 days, potentially surpassing $150,000 within three months.