China’s Economic Crisis

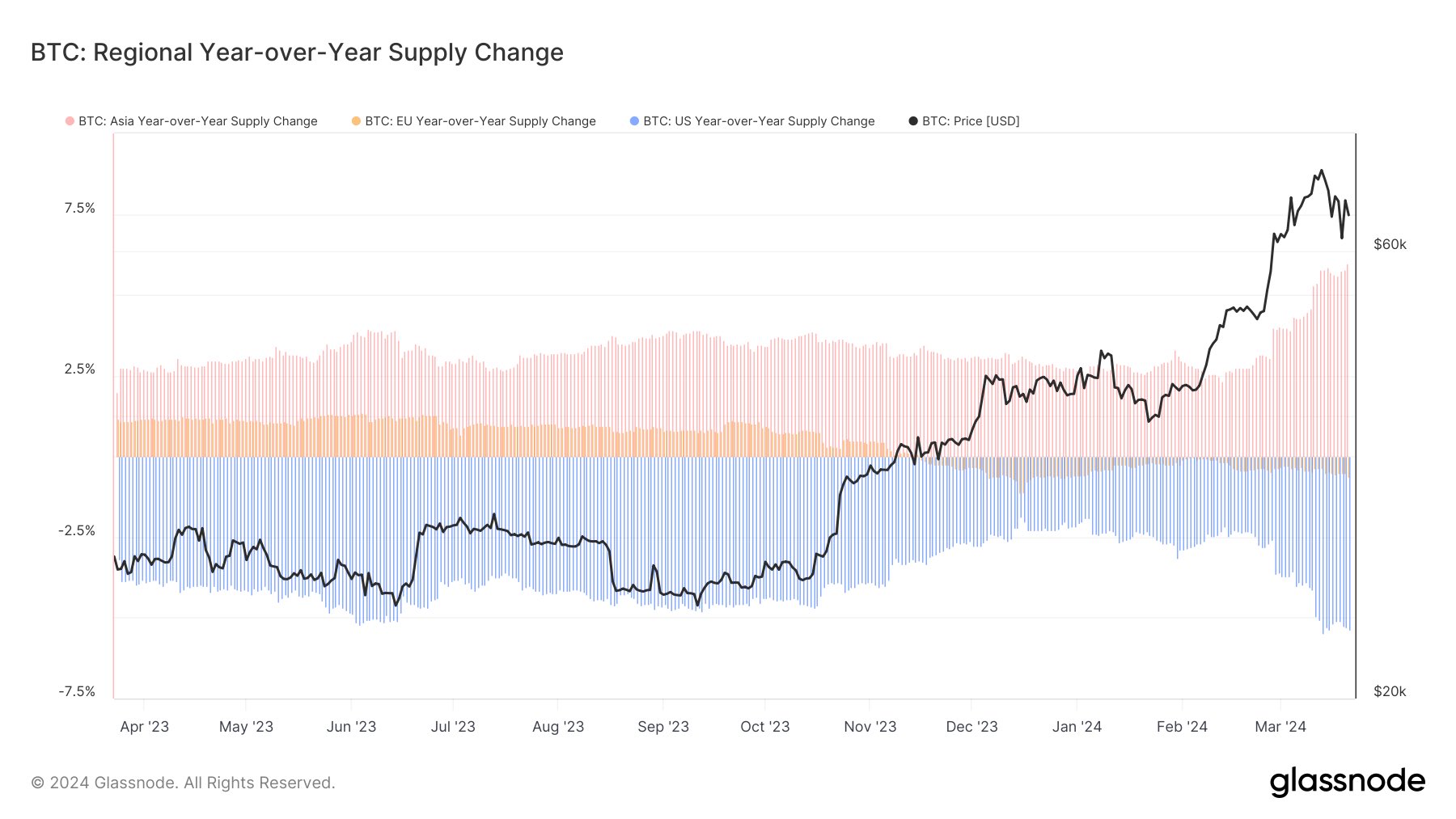

China is facing a major economic crisis, with a high debt-to-GDP ratio and a collapsing housing market. This has led to a massive outflow of capital from China, as investors seek safer investment options.

Hong Kong’s Spot Bitcoin ETFs

Hong Kong is considering approving spot Bitcoin ETFs, which would allow investors to directly invest in Bitcoin. This could be a major boon for Chinese investors who are looking for ways to diversify their portfolios and protect their wealth.

The Role of Hong Kong

Hong Kong is a major trading partner with China, and it is likely that Chinese investors will be able to access Hong Kong’s spot Bitcoin ETFs. This could lead to a significant inflow of capital into Bitcoin, driving up its price.

SEC Approval and Enthusiasm

The SEC has already approved similar ETFs in the US, which have seen a huge influx of investment. The approval of spot Bitcoin ETFs in Hong Kong is expected to have a similar effect, with investors flocking to Bitcoin as a safe haven.

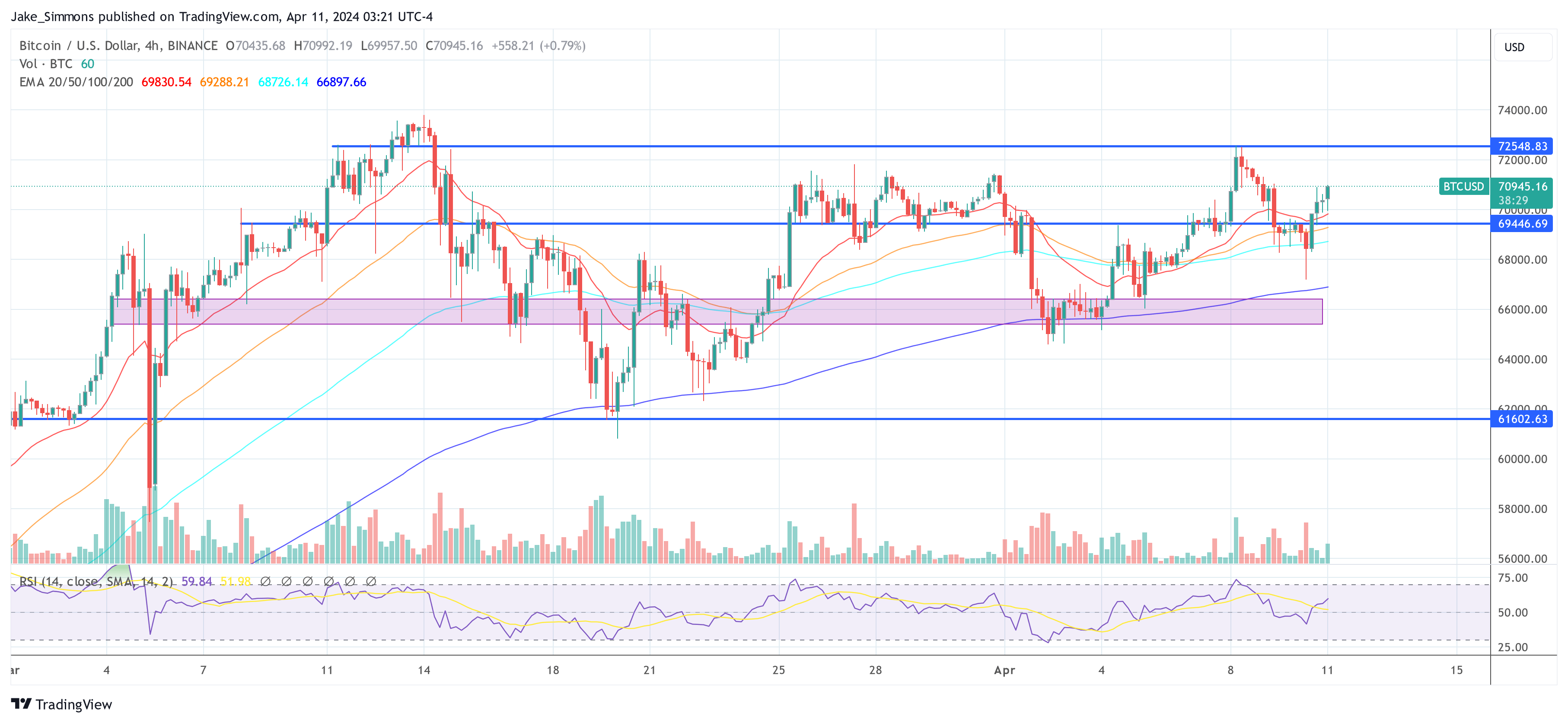

Potential Impact on Bitcoin’s Price

Analysts believe that the approval of spot Bitcoin ETFs in Hong Kong could be a major catalyst for Bitcoin’s price, potentially driving it to $100,000 or higher. This would be a significant milestone for Bitcoin, and it could further solidify its status as a legitimate investment asset.