Bitcoin recently hit a new all-time high, around $122,800, but then took a dive. Why didn’t it break the $123,000 mark? Let’s find out.

The $123,000 Hurdle

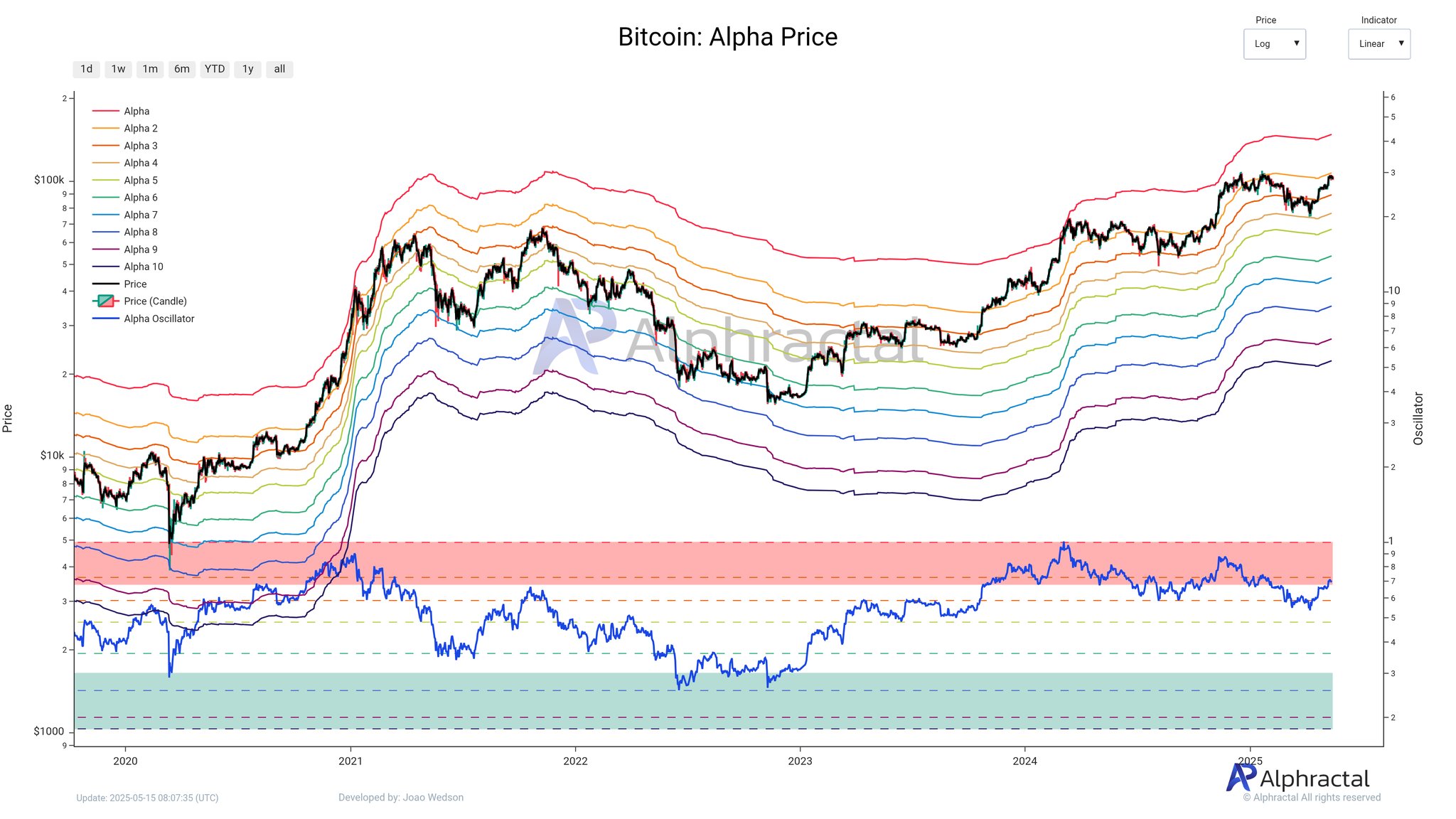

A crypto expert, Joao Wedson, CEO and founder of Alphractal, explains that Bitcoin’s failure to surpass $123,000 is significant. This is because $123,370 represents the second “Alpha Price” level.

What’s the Alpha Price?

The Alpha Price is a clever on-chain indicator. It uses things like market age and average market cap to figure out where Bitcoin’s price might find support or resistance. Think of it as a gauge of investor sentiment. Breaking through these levels signals a shift in the market. Lower Alpha Price levels act as support (investors buy to protect their investments), while higher levels mean more selling pressure (people cashing in profits).

Wedson explains that the Alpha Price is calculated using the market’s age in days to determine the average market cap, which acts as a historical valuation baseline.

The Alpha Price isn’t just one number; it has multiple levels, acting like pressure points. Bitcoin needs to break through and stay above these levels to enter the next big bull market phase.

Short-Term Outlook and Future Potential

Bitcoin’s failure to break the second Alpha Price level doesn’t automatically mean the market’s peaked. However, $123,370 is a strong resistance zone, suggesting a potential pullback before further price increases. The Alpha Price is dynamic, updating regularly based on real-time market activity.

Even with the recent dip, a move towards $143,000 is still possible if Bitcoin can break through the current Alpha Price level.

Current Bitcoin Price

At the time of writing, Bitcoin is trading around $117,610, down over 2% in the last 24 hours.