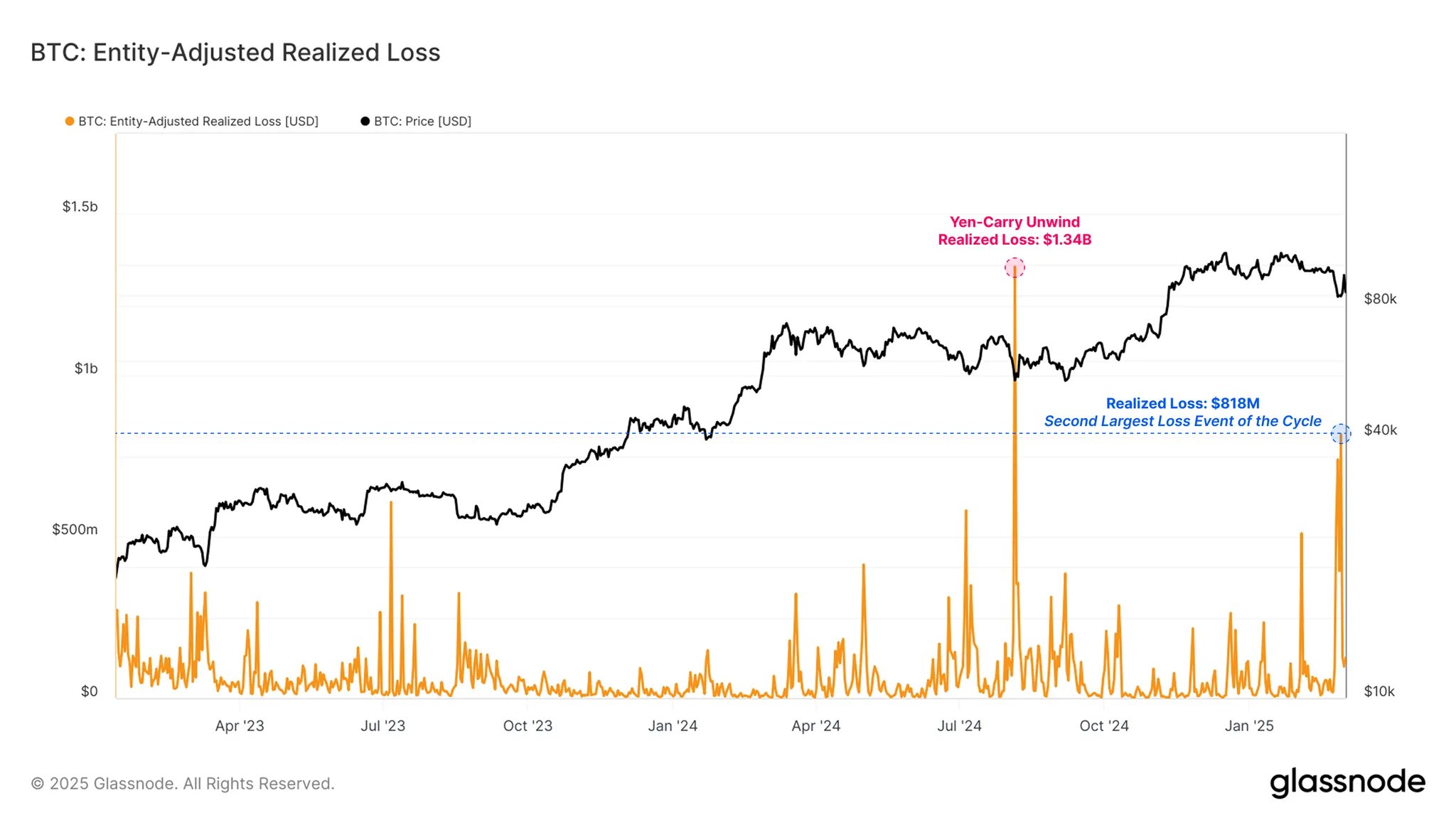

Bitcoin’s price recently took a tumble, causing investors to offload a significant amount of their holdings at a loss. This sell-off wasn’t just a minor dip; it resulted in a massive $818 million in realized losses – the second largest this year.

What is Realized Loss?

On-chain data, specifically the “Realized Loss” metric, tracks the actual losses investors experience when selling Bitcoin. It works by looking at each Bitcoin’s transaction history. If a Bitcoin is sold for less than its previous sale price, that’s a realized loss. The metric adds up all these individual losses across the entire network to get a total picture. Glassnode, a crypto analytics firm, uses an “Entity-Adjusted” version, meaning it only counts losses when Bitcoin moves between different investors (not just between different wallets owned by the same person).

The Recent Spike

A recent chart from Glassnode showed a huge spike in this Entity-Adjusted Realized Loss. This means lots of investors sold Bitcoin at a loss. This massive sell-off, or “capitulation,” is directly related to Bitcoin’s recent price drop.

Historical Context

This $818 million loss is significant, but it’s not the biggest this year. The largest loss event happened during the yen-carry trade unwind, resulting in a staggering $1.34 billion in realized losses. Historically, these large sell-offs have often marked the bottom of Bitcoin’s price decline, as coins move from less confident holders to those who are more bullish.

What’s Next?

It remains to be seen if this latest spike in realized losses will signal a similar bottom for Bitcoin’s price. At the time of writing, Bitcoin is trading around $90,300, showing a recovery of almost 7% over the past week.