Bitcoin had a great run last week, soaring past $88,000. But then things took a turn.

A Price Correction

After the latest inflation data dropped on Friday, March 28th, Bitcoin took a significant dive. It’s now trading below $84,000, and some investors are getting nervous about further price drops.

Key Support Levels: Where’s the Bottom?

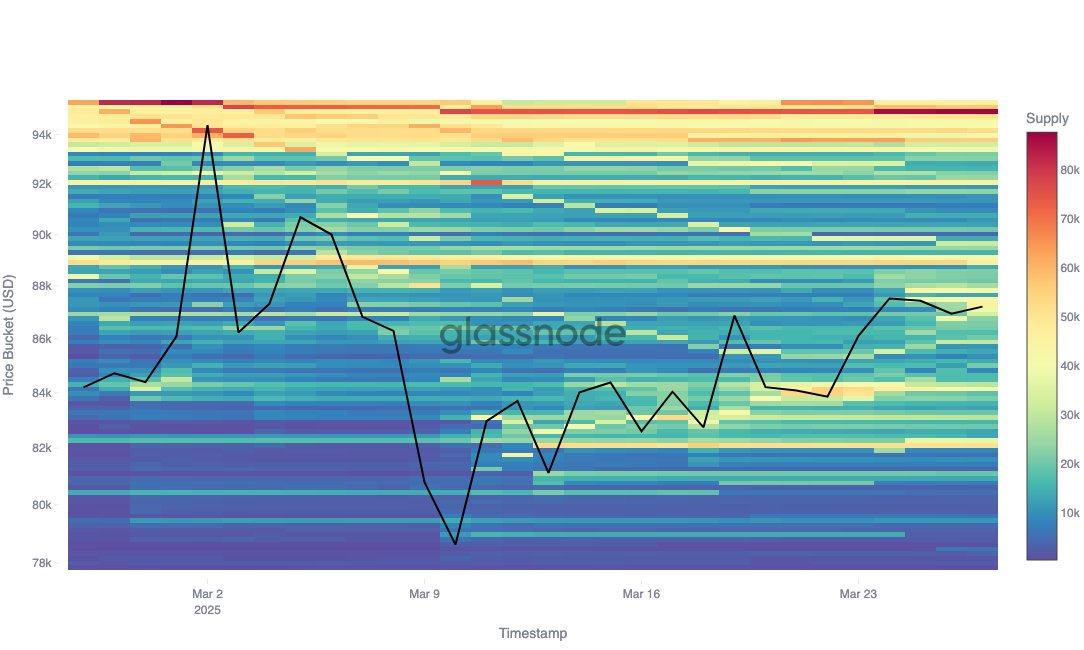

Luckily, on-chain data can give us some clues about where Bitcoin might find support. Glassnode, a blockchain analytics firm, looked at investor behavior and cost basis to predict future price movements. Basically, they’re analyzing where large groups of investors bought Bitcoin, which can indicate potential support levels.

What the Data Shows

Glassnode’s analysis reveals some interesting things:

- A significant number of traders bought around 15,000 BTC at $78,000 and later sold near the recent high of $87,000. This weakens the support at $78,000.

- Stronger support levels exist around $84,100 (40,000 BTC bought), $82,090 (50,000 BTC), and $80,920 (20,000 BTC). If Bitcoin breaks below these levels, a more significant drop is possible.

- If the price falls below $80,000, the next key support levels are $74,000 (49,000 BTC bought) and $71,000 (41,000 BTC). Glassnode believes these levels could absorb some of the downward pressure.

Current Price and Outlook

At the time of writing, Bitcoin is trading around $83,800, down almost 4% in the last 24 hours. While a further drop to $71,000 is possible based on the analysis, the presence of these support levels suggests there’s potential for the price to stabilize. However, the situation remains uncertain.