Bitcoin took a bit of a dive, dropping 11% from its peak. Sounds scary, right? But let’s look at the bigger picture.

Bitcoin’s History: A Rollercoaster Ride

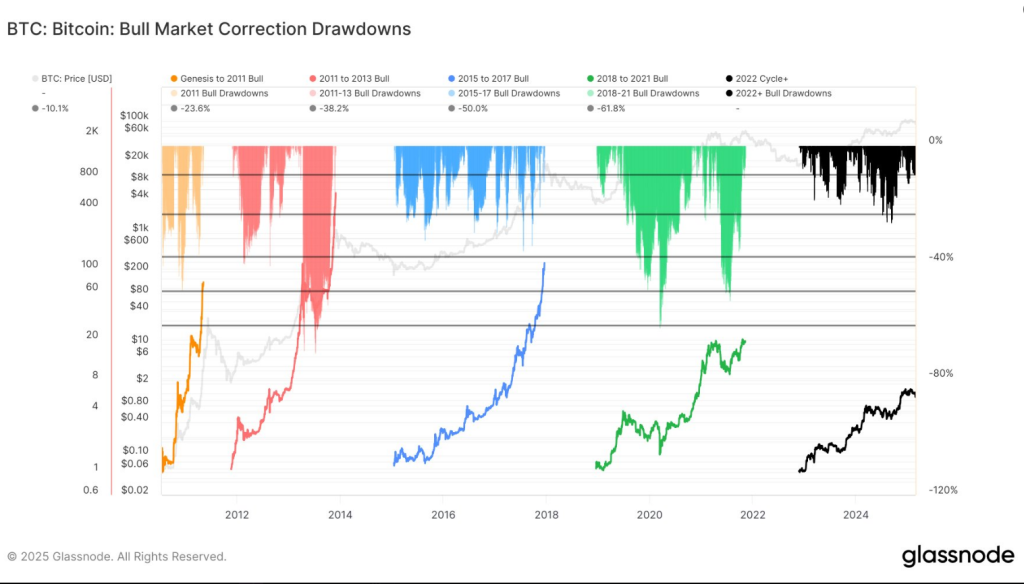

Bitcoin’s price has always been volatile. Think wild swings up and down. Looking back, dips of 10% or more have happened at least 13 times between 2012 and 2017 alone! Some corrections have even wiped out billions of dollars before recovering. So, an 11% drop isn’t exactly unheard of.

Comparing This Dip to Past Cycles

Here’s how this recent dip stacks up against previous Bitcoin cycles:

- 2011-2013: Average drop: -19.19%, Maximum drop: -49.45%

- 2015-2017: Average drop: -11.49%, Maximum drop: -36.01%

- 2018-2021: Average drop: -20.41%, Maximum drop: -62.62%

- Current Cycle: This cycle is actually

less volatile than previous ones.

The point? Bitcoin’s price bounces back. These dips are normal, even during bull markets. They often shake out weaker investors before the price climbs again.

The Current Situation

On February 27, 2025, Bitcoin traded around $85,800, down about 4% from the previous day. The price fluctuated between $82,460 and $89,230. While the recent weekly drop of 15% exceeds the cycle’s average drawdown of 8.5%, it’s still significantly smaller than past corrections. Many analysts see this as a normal part of the cycle, not a major crisis.

However, if Bitcoin doesn’t quickly climb back above $92,000, further price drops are possible. This level is important because it’s where many short-term traders start making profits. Otherwise, a retracement to around $70,000-$71,000 might happen.

What Caused the Dip?

Several factors contributed to the recent price drop:

- Investor Sentiment:

Market confidence is a huge factor in Bitcoin’s price. Even slight shifts in investor trust can cause big swings.

- Security Concerns: The Bybit hack, which resulted in $1.5 billion in losses, fueled panic selling.

- Global Economic Uncertainty: Inflation fears, central bank policies, and general economic worries make investors more cautious about risky assets like Bitcoin.

In short, external pressures often drive Bitcoin’s volatility.

The Bottom Line

Despite the recent dip, Bitcoin’s history shows a pattern of growth punctuated by dips. While the current situation warrants attention, based on past performance, this 11% drop is relatively modest within the context of Bitcoin’s overall volatility.