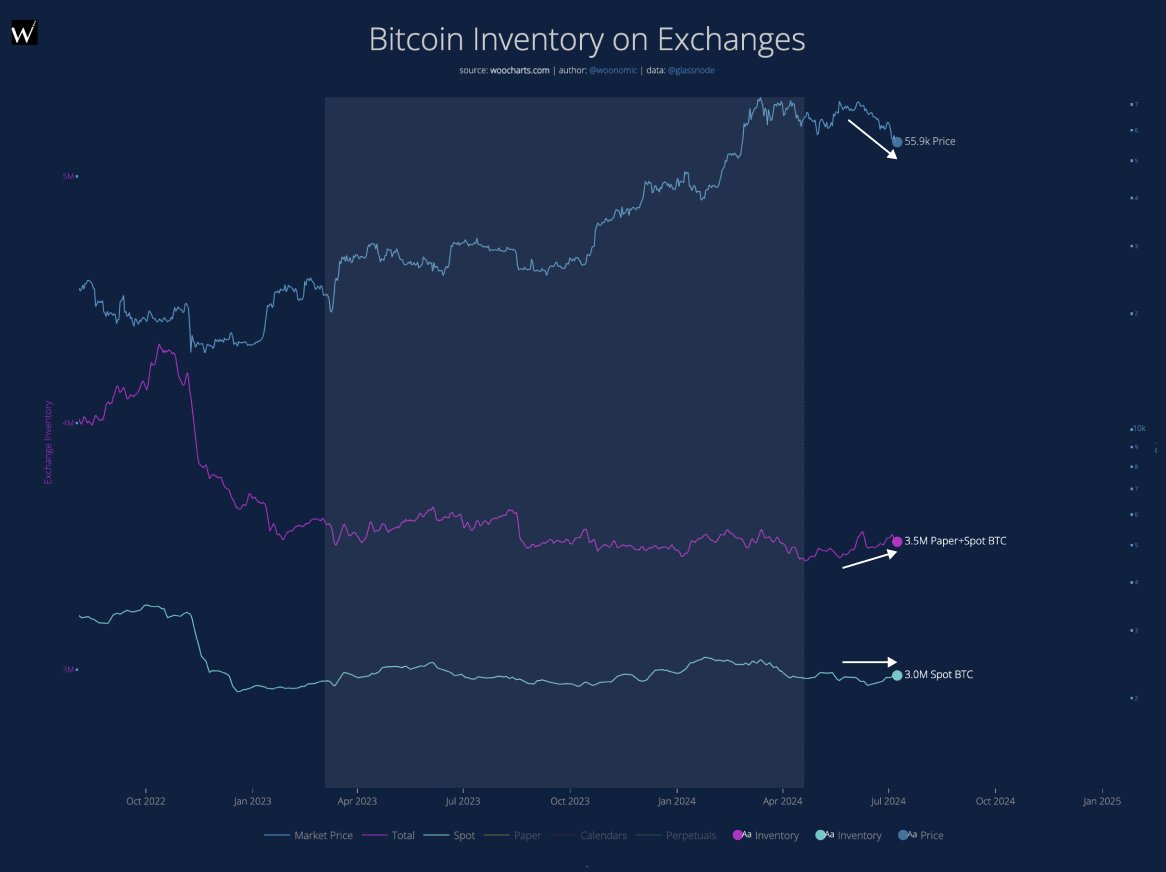

Bitcoin has been on a downward trend lately, and everyone’s trying to figure out why. While some blame the German government selling off some of its Bitcoin holdings and the upcoming Mt. Gox distributions, there might be a bigger culprit: paper Bitcoin.

What is Paper Bitcoin?

Paper Bitcoin refers to derivatives products related to Bitcoin. These products don’t require you to actually own any Bitcoin. They’re basically bets on the price of Bitcoin going up or down.

The Paper Bitcoin Surge

A recent analysis shows that the amount of paper Bitcoin has been increasing while the amount of actual Bitcoin held on exchanges has remained relatively flat. This suggests that the recent drop in Bitcoin’s price might be driven by a surge in paper Bitcoin, not actual selling pressure.

Derivatives Could Be the Key to Bitcoin’s Recovery

The analyst believes that if Bitcoin wants to recover, the derivatives market will need to see a significant shift. This means that people holding paper Bitcoin might need to start buying actual Bitcoin to cover their positions.

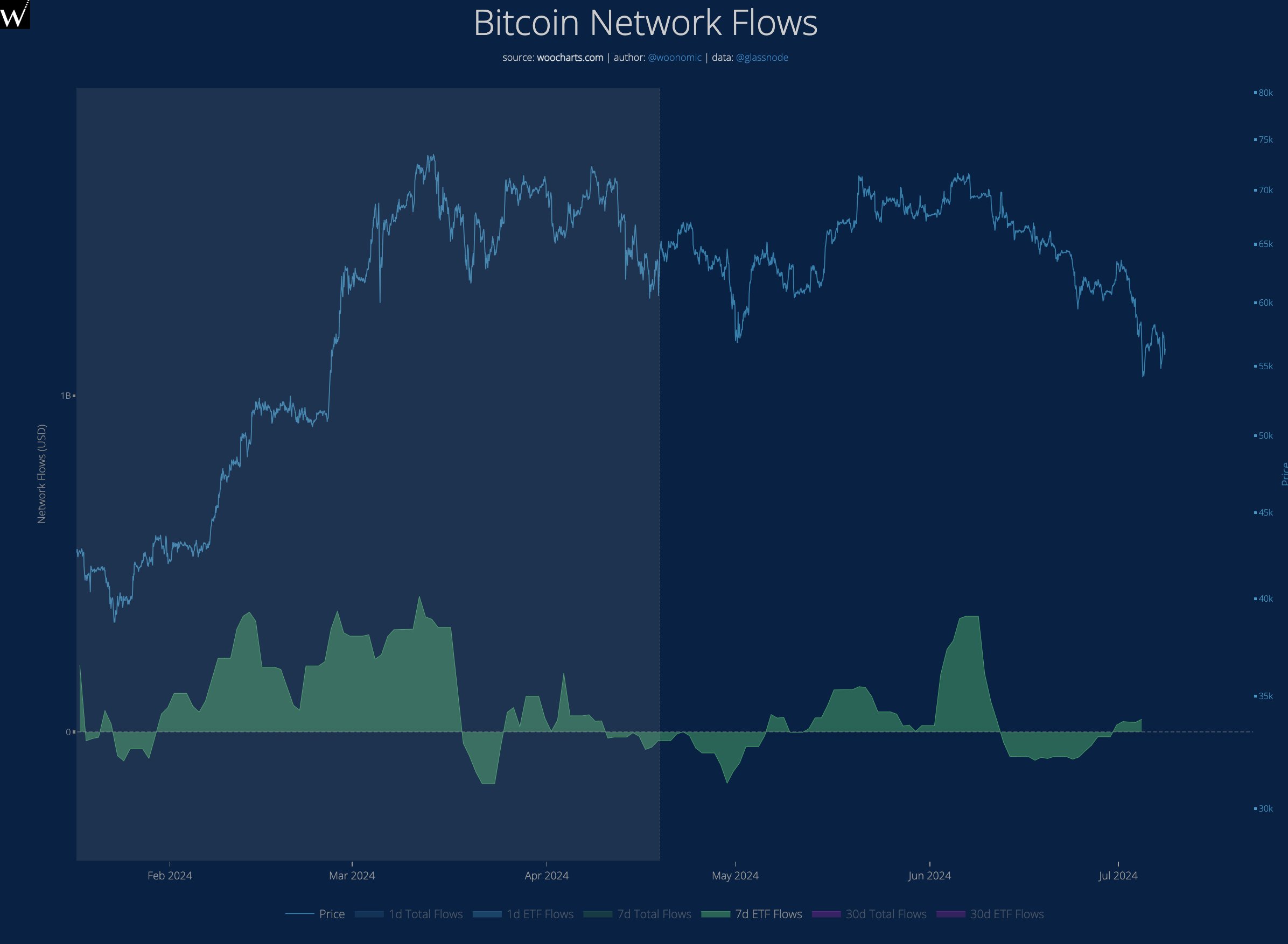

A Glimpse of Hope: Spot ETFs

While the market is facing some bearish pressure, there’s also a potential bullish development on the horizon. Spot exchange-traded funds (ETFs) are starting to show signs of accumulating Bitcoin, which could be a positive sign for the future.

The Bottom Line

Bitcoin’s recent crash might be more about derivatives than actual selling pressure. While the market faces some challenges, the potential for spot ETFs could offer a glimmer of hope for the future.