Bitcoin has been on a roll lately, hitting prices not seen since July. But some experts are worried that this rally might not last.

Why Bitcoin’s Rally Could Be Short-Lived

One analyst, known as Wenry, has pointed out some concerning signs:

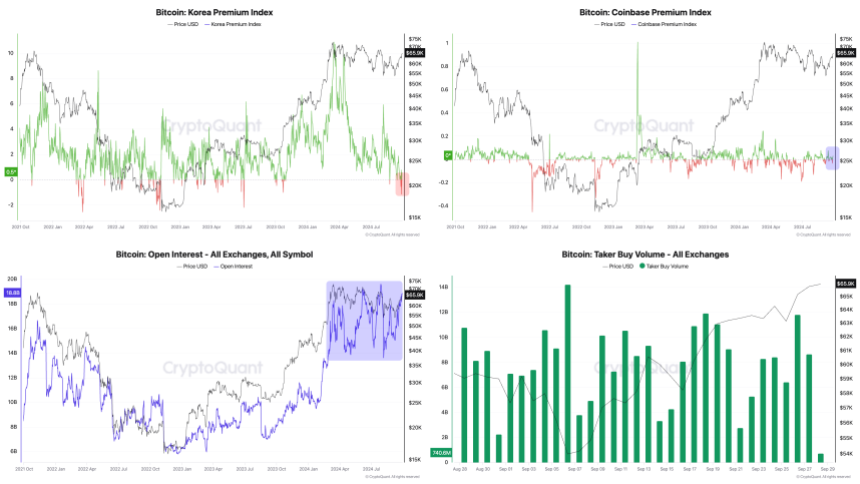

- Lack of Retail Interest: Retail investors in Korea and the US, who usually play a big role in Bitcoin price rallies, aren’t showing much interest this time. This suggests the current surge might be driven by a small group of players, not a broader market shift.

- High Open Interest, Low Volume: There’s a lot of interest in Bitcoin, but not much actual buying. This means the price is stuck in a narrow range, and a big drop could be coming.

- Derivatives Driving the Rally: The rise in Bitcoin’s price seems to be driven by derivatives trading, not by people actually buying and holding the cryptocurrency. This means the rally could be temporary, fueled by macroeconomic factors like interest rate cuts.

If retail investors don’t start buying Bitcoin, it could stay stuck in this range or even drop in price.

Will Bitcoin Break Its All-Time High?

Another analyst, Michaël van de Poppe, is more optimistic. He thinks Bitcoin could reach a new all-time high in the last quarter of 2024, following a similar path as gold. He also predicts a 3-5x price surge for other cryptocurrencies during the same period.

Only time will tell if either of these predictions is right. For now, Bitcoin is still trading at around $65,810, but its trading volume has dropped significantly.