Bitcoin’s price has been pretty stagnant lately, hanging around $108,000. While the price action isn’t exactly thrilling, some interesting things are happening behind the scenes.

Money’s Moving Out: A Sign of Confidence?

New data suggests Bitcoin investors are feeling pretty bullish about the future. For months, more Bitcoin has been leaving exchanges than entering them. This is a big deal.

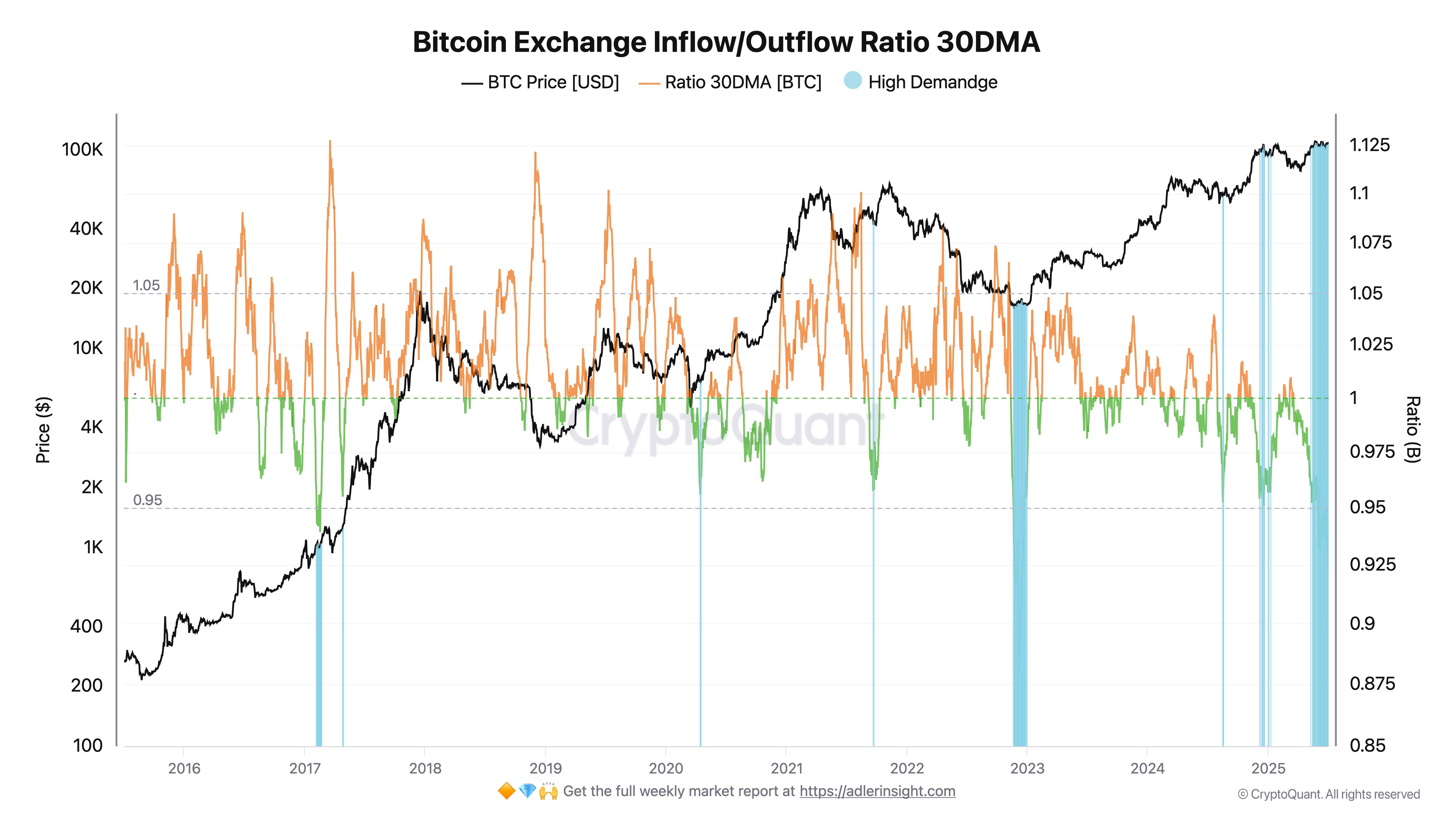

This trend is tracked using something called the Bitcoin Exchange Inflow/Outflow Ratio (30DMA). Basically, it measures whether more Bitcoin is going into exchanges (people selling) or out of exchanges (people holding). A ratio below 1 means more Bitcoin is leaving exchanges – people are holding onto their coins.

Recently, this ratio dropped to around 0.9, the lowest it’s been since the 2023 bear market. This means a significant amount of Bitcoin is being taken off

One analyst, Darkfost, points out that this outflow shows strong and sustained demand. They believe more long-term holders are accumulating Bitcoin. They also see this trend as a natural result of growing adoption by big companies and governments, especially in the US. They suggest Bitcoin is becoming a more accepted store of value, even used to bolster company reserves.

Bitcoin’s Price: A Quick Look

At the time of writing, Bitcoin is trading around $108,103, up a tiny 0.3% in the last 24 hours. While the price isn’t skyrocketing, the underlying data paints a picture of growing investor confidence.