Crypto analyst Rekt Capital shares his insights on Bitcoin (BTC) after a recent 9% drop.

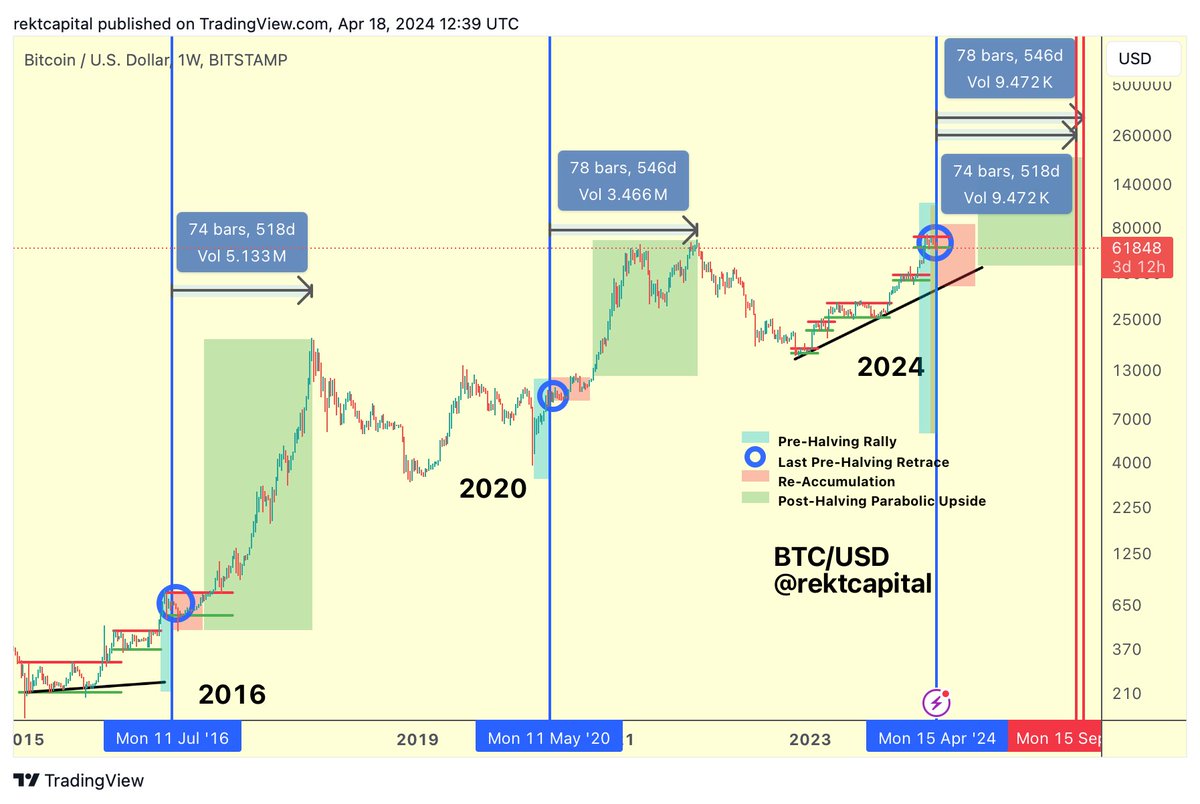

Re-Accumulation and Fake Breakdowns

Rekt Capital warns that Bitcoin’s current re-accumulation phase may lead to false assumptions of a breakdown. He notes that previous accumulation ranges have often included downward wicks that trick investors into thinking the trend is reversing, before it resumes its uptrend.

Halving and Bull Market Peak

With the Bitcoin halving approaching, Rekt Capital suggests that the next bull market peak is still about a year and a half away. He predicts it may occur between mid-September and mid-October 2025.

Pullback and Bargain Territory

Despite the recent pullback, Rekt Capital believes Bitcoin has weathered worse in the past. He points out that the current 18% pullback, which has lasted 10 days, is close to bargain-buying territory. However, he notes that the duration of the pullback is still relatively short compared to previous ones.

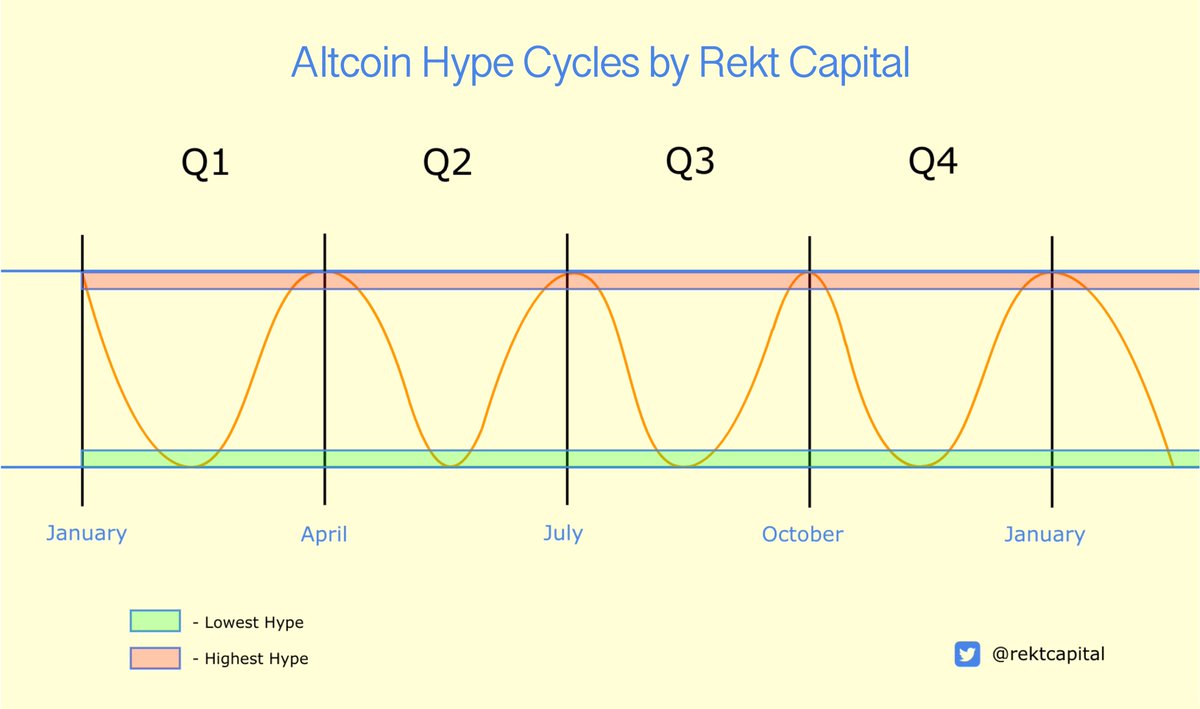

Altcoins in a Downswing

Rekt Capital also predicts that altcoins are in a downswing until at least late May or early June. He believes that the Q1 altcoin hype cycle has ended and investors should be patient before expecting another surge.