A recent analysis of Bitcoin’s price suggests a possible repeat of last year’s rally, but also highlights potential risks. Let’s break down what’s happening.

RSI Retest: A Key Indicator?

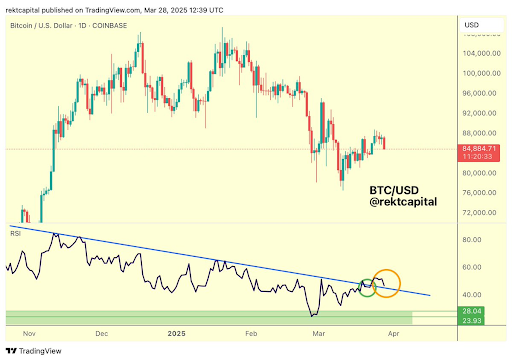

Crypto analyst Rekt Capital noticed Bitcoin’s Relative Strength Index (RSI) is mirroring a pattern from before a significant price jump in 2024. The RSI recently retested a downtrend line, similar to what happened before the rally. Another retest is happening now. A successful retest above the 40 level could signal another price surge. However, falling below 40 could mean another downturn.

Price Drop and Macroeconomic Factors

Bitcoin’s price has recently dipped from around $88,500 to below $84,000. This drop is partly due to macroeconomic factors like potential trade wars and Federal Reserve policies. Trading firm QCP Capital believes the uncertainty surrounding these factors is limiting any significant price increase. Inflation data also added to the bearish sentiment.

Potential Bottom and Bullish Predictions

Analyst Titan of Crypto thinks Bitcoin might have hit a temporary bottom. He points to several support levels that Bitcoin has held in the past, suggesting a possible bounce. He previously predicted a rise to $91,000 based on a bullish pennant chart pattern.

However, not everyone is optimistic. Veteran trader Peter Brandt is predicting a much lower price, potentially as low as $65,635.

Current Price and Conclusion

At the time of writing, Bitcoin is trading around $83,900, down slightly. The current situation is a mixed bag. While some analysts see potential for another rally based on RSI patterns and support levels, others are more cautious due to macroeconomic headwinds and potential corrections. The next few days will be crucial in determining Bitcoin’s direction.