The Quiet and Trending Phase

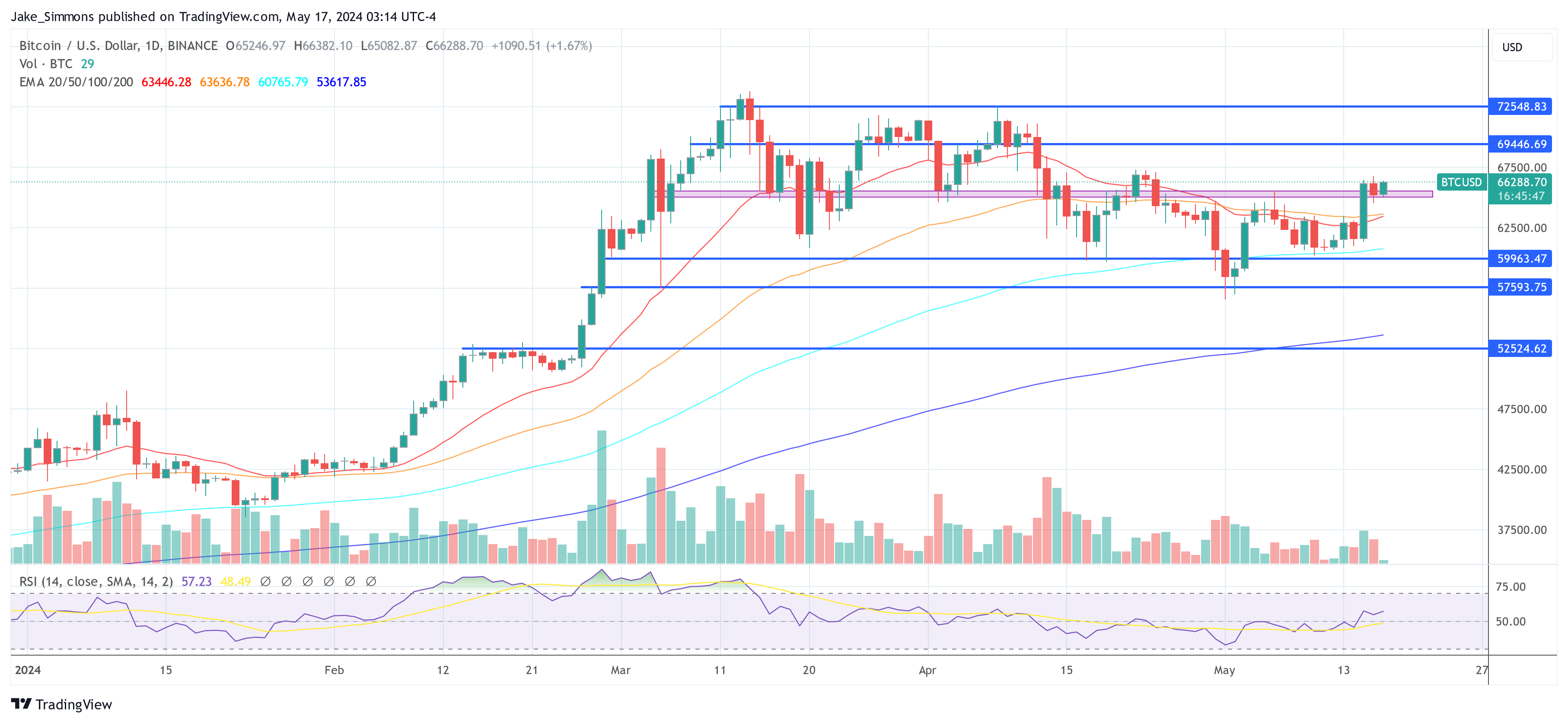

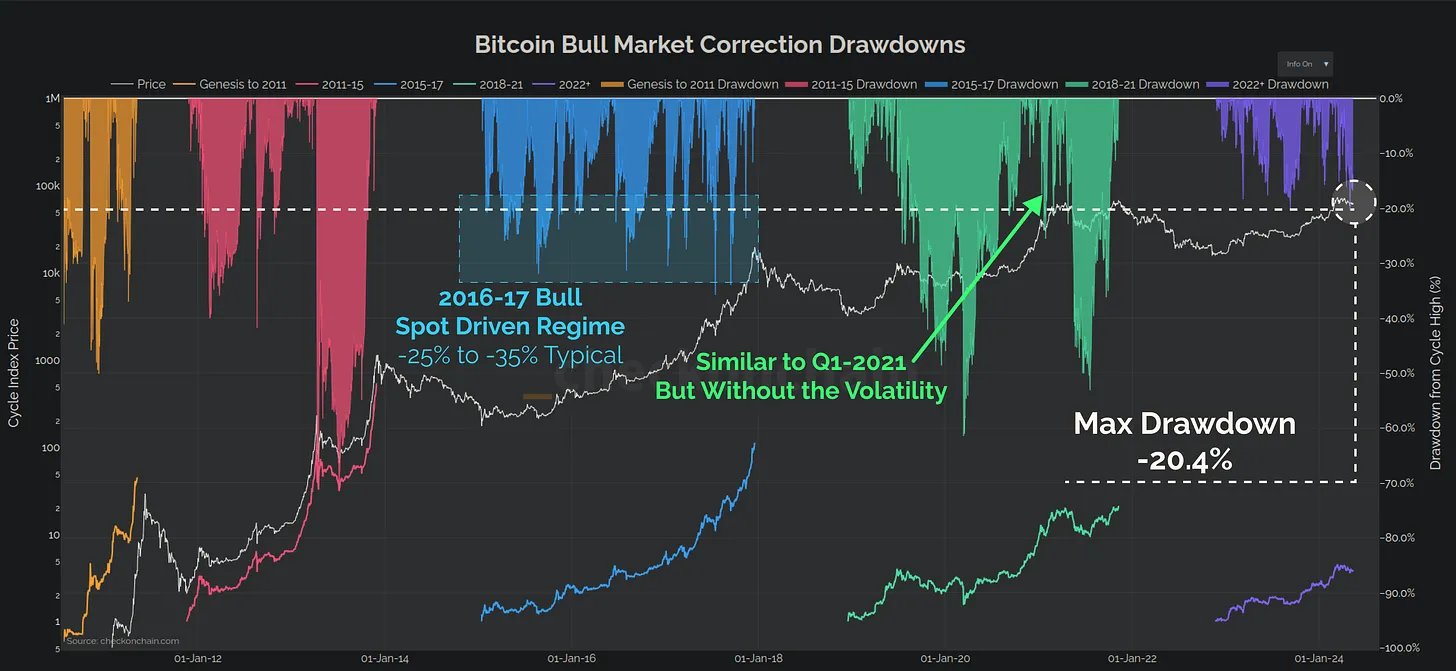

Bitcoin has been facing a lot of selling pressure lately, with over 1.5 million BTC being sold. But despite this, the price has only dropped by about 20%. This shows that Bitcoin has strong support levels.

Volatility: Not Always a Bad Thing

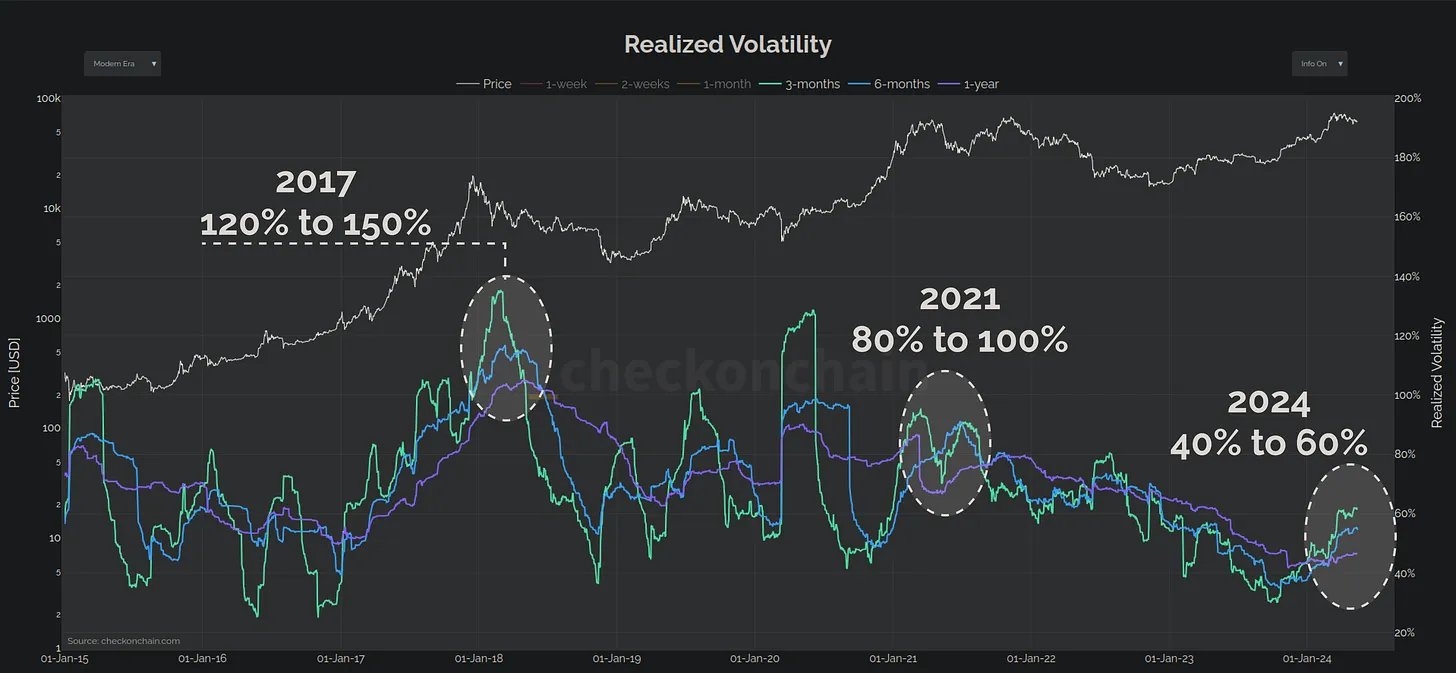

Bitcoin’s volatility has been decreasing lately. This is a sign that the market is maturing and becoming more stable. But don’t forget that volatility can also be good, as it can lead to price increases.

Short-Term Holder Sentiment

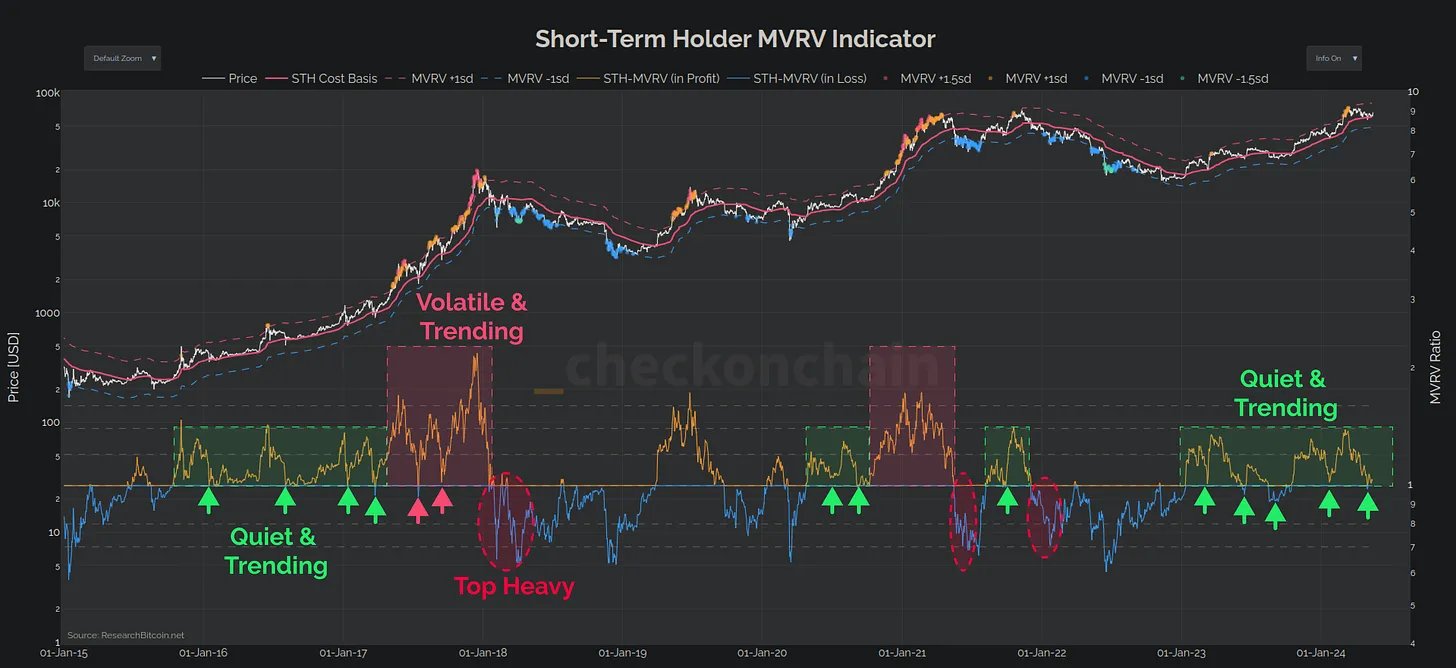

The Short-Term Holder MVRV Ratio is a tool that helps us understand the sentiment of short-term Bitcoin holders. This ratio has been holding steady between 1.0 and 1.4, which is a sign of stability.

Profitability and Panic Selling

Even though Bitcoin’s price has dropped, short-term holders are still profitable. This means that the market is not top-heavy. Some local top buyers have panic sold their Bitcoin, which has helped to stabilize the market.

Bitcoin vs. Stocks

Bitcoin’s volatility is actually quite low compared to top-performing US stocks. This shows that Bitcoin is not as risky as some people think.

Conclusion

Bitcoin is in a “Quiet and Trending” phase, which means that it is consolidating before another rally. Volatility may increase during this phase, but this is not necessarily a bad thing. Overall, the Bitcoin uptrend looks strong, and the market is maturing.