Bitcoin’s price is hanging around $84,000, and experts are weighing in on what this means for the future.

Key Support and Resistance Levels

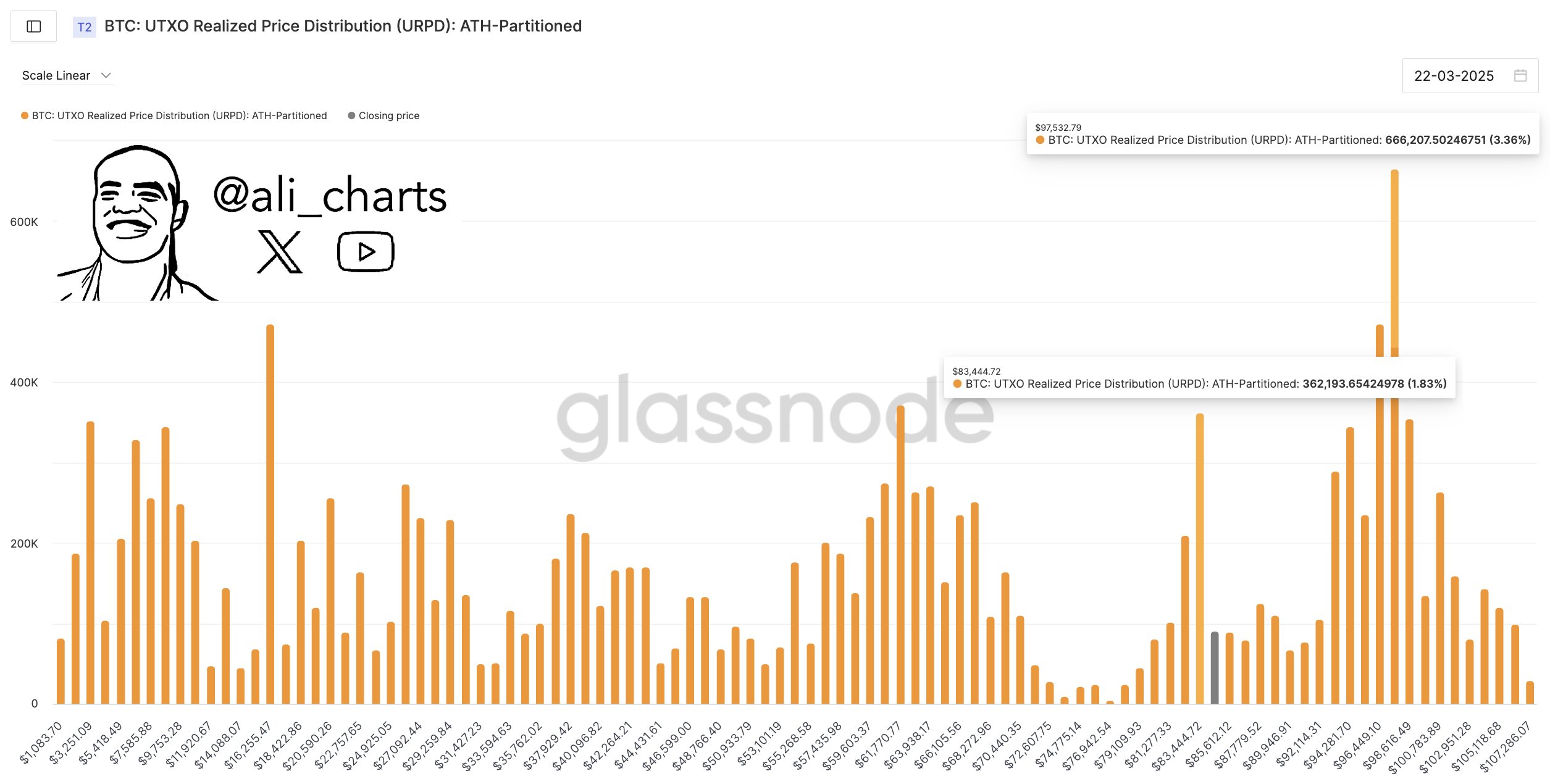

Crypto analyst Ali Martinez used something called UTXO Realized Price Distribution (URPD) to pinpoint important price levels for Bitcoin. Think of URPD as a way to see where a lot of Bitcoin was last bought or sold. This helps identify support (a price floor) and resistance (a price ceiling).

Martinez found strong support around $83,444. This means many investors bought Bitcoin around that price, making it less likely to fall much further. However, a major resistance level sits at $97,532. Breaking through this resistance could signal a new bull run, potentially pushing Bitcoin to new all-time highs. Failure to break through could mean more sideways trading or even a price drop.

Is Now the Time to Buy?

Martinez also looked at the Bitcoin Sharpe Ratio, which measures risk versus reward. A low Sharpe Ratio suggests a good time to buy, while a high ratio indicates higher risk. Currently, the ratio suggests high risk, meaning potential buyers might want to wait for a better opportunity. Martinez hinted that a low Sharpe ratio might be coming soon, indicating a potentially good buying window.

The Current Situation

Bitcoin is currently trading slightly above the key support level, but trading volume is down significantly. This suggests some uncertainty in the market. While the price is showing some positive signs, the overall picture is one of consolidation, waiting to see if it can break through that major resistance at $97,532.