Bitcoin’s price has been stuck in a rut lately, failing to build on its recent gains. It’s hovering around $62,000, which is a bit of a bummer for those hoping for a big jump.

Short-Term Holders Feeling the Heat

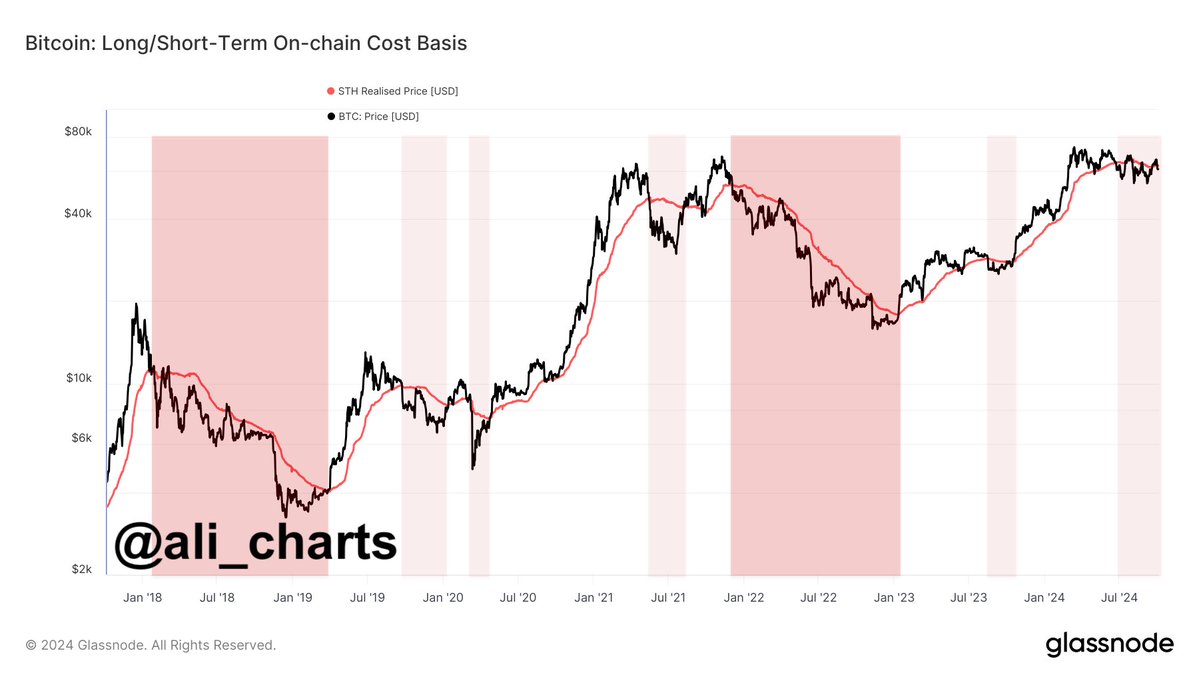

The problem? Short-term Bitcoin holders are feeling the pinch. They bought their Bitcoin at a higher price than the current market value, meaning they’re losing money.

This is a big deal because when people are losing money, they’re more likely to sell their Bitcoin to cut their losses. This puts downward pressure on the price, making it even harder for Bitcoin to climb back up.

A Look Back in Time

Historically, Bitcoin has followed a similar pattern after halving events (when the rate at which new Bitcoins are created is cut in half). In 2016 and 2020, we saw a surge in short-term Bitcoin supply, followed by a cooling period.

This time around, we saw a similar spike in short-term supply after the launch of Bitcoin ETFs earlier this year. If history repeats itself, we could see another rise in short-term supply, which could further impact Bitcoin’s price.

What Does This Mean for Bitcoin?

The short-term outlook for Bitcoin isn’t looking great. With short-term holders feeling the pressure, the price could continue to drop in the near future.

However, it’s important to remember that the long-term outlook for Bitcoin is still positive. Many analysts believe that Bitcoin will continue to grow in value over time.

So, while the current situation might be a bit of a downer, it’s important to stay calm and remember that the future of Bitcoin is still bright.