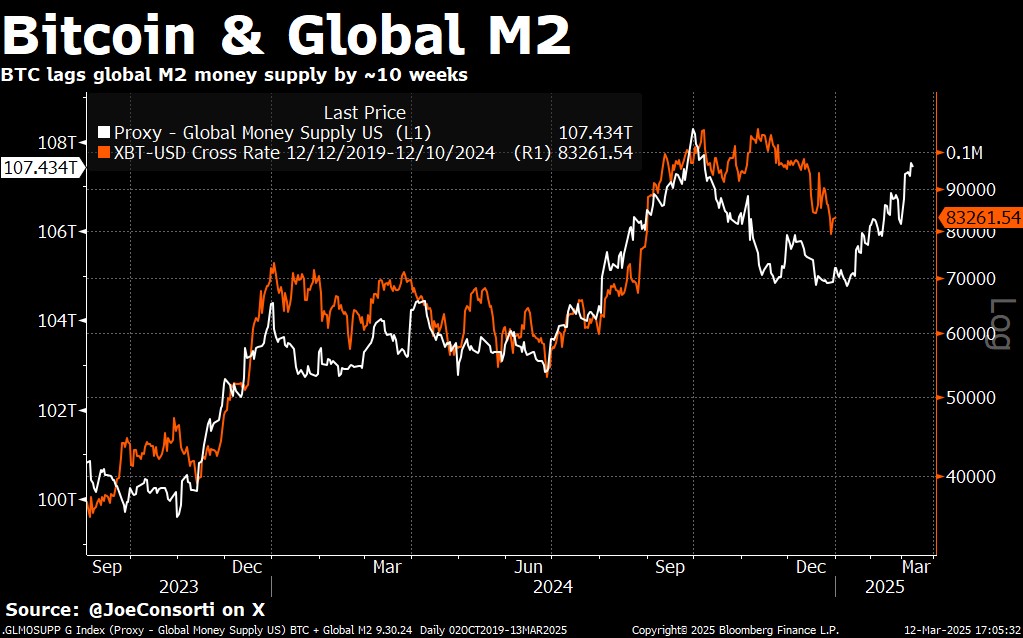

Bitcoin’s price is still closely linked to the global money supply (M2), despite other news making headlines. This connection, showing a roughly 70-day lag, means Bitcoin’s price often follows trends in M2.

The M2-Bitcoin Connection

Analyst Joe Consorti highlights that Bitcoin’s price is heavily influenced by changes in the global money supply. Even though there was a brief period where this connection seemed weaker, Bitcoin’s recent price drop to around $78,000 shows it’s back in sync with M2’s downward trend. While this isn’t a perfect one-to-one relationship, it’s a useful tool for understanding Bitcoin’s price movements in the broader economic context. The strong US dollar is currently affecting this relationship, making M2 a less reliable indicator on its own.

The Unexpected Reaction to the US Bitcoin Reserve

The announcement of a US Strategic Bitcoin Reserve (SBR), where the government plans to accumulate Bitcoin without additional taxpayer money, caused a surprising 8.5% drop in Bitcoin’s price. Consorti calls this an “irrational reaction,” showing the market isn’t fully grasping the long-term implications of this move. This contrasts sharply with El Salvador’s adoption of Bitcoin as legal tender, which led to a price surge.

Signs of a Potential Bottom?

Despite the dip caused by the SBR news, some technical indicators suggest Bitcoin might have hit a bottom. The price bounced back after reaching around $77,000, forming patterns (hammer candlesticks) that often signal a price reversal. This is similar to patterns seen before previous price surges.

Bitcoin’s Growing Dominance

Interestingly, Bitcoin’s dominance in the crypto market is increasing, even as prices fluctuate. The price of Ethereum relative to Bitcoin is at its lowest since May 2020, and institutional investment in Ethereum is also down significantly. This suggests that Bitcoin is becoming the dominant force in the cryptocurrency world. Consorti believes this trend will only continue.

The Bottom Line

Currently, Bitcoin is trading around $82,875. While the global money supply remains a key factor influencing its price, other events, like the creation of the US Bitcoin Reserve, can cause short-term volatility. However, technical analysis suggests a potential bottom, and Bitcoin’s increasing dominance in the crypto market points to a strong future.