Bitcoin’s been stuck in a rut lately, especially on weekends. While Friday night saw a promising jump, it’s back to its usual weekend sluggishness. This has put Bitcoin in a tight price range between $97,000 and $98,000.

Key Price Levels to Watch

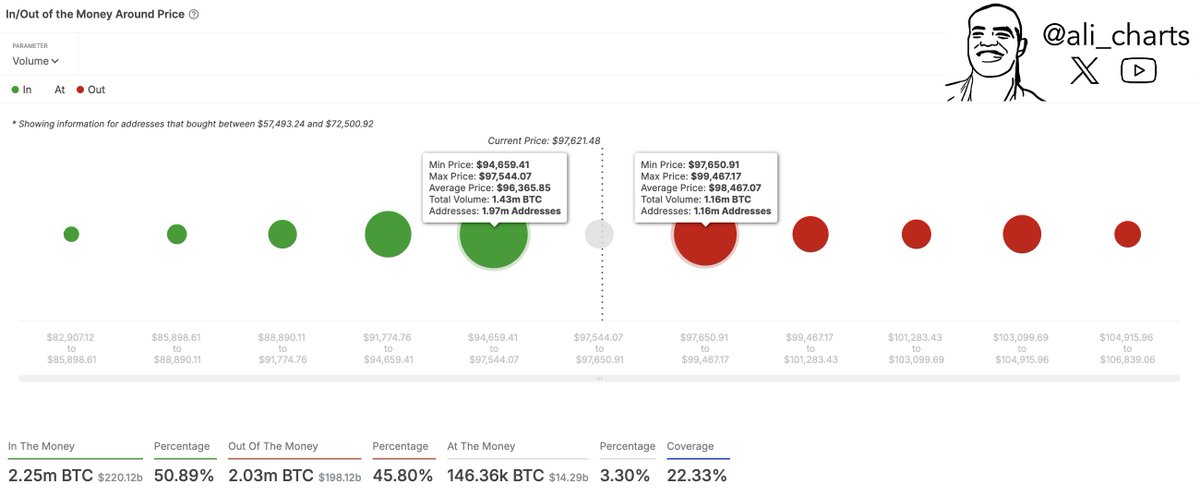

Crypto analyst Ali Martinez highlighted some interesting on-chain data showing Bitcoin trapped between two crucial price points. This analysis looks at the average price paid by Bitcoin investors (their “cost basis”). The size of the investment at each price point is important; a large number of investors who bought at a certain price can create strong support or resistance.

The Support Level: $96,365

Data shows around 1.97 million Bitcoin addresses bought roughly 1.43 million BTC between $94,659 and $97,544 (averaging $96,365). This means a lot of investors bought around this price. If Bitcoin drops to $96,365, these investors might buy more to avoid losses, acting as a support level.

The Resistance Level: $98,467

Similarly, the $97,650 to $99,470 range shows about 1.16 million addresses holding over 1.16 million BTC. If Bitcoin rises to this level, some investors who bought higher might sell to avoid further losses, creating resistance.

What This Means for Bitcoin

Bitcoin’s currently sandwiched between these two levels, making its short-term future uncertain. A breakout above $98,467 could signal a bullish trend, while a fall below $96,365 could lead to further price drops. It’s a crucial moment that could determine Bitcoin’s direction in the coming weeks.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading around $97,700, showing little change in the last 24 hours.