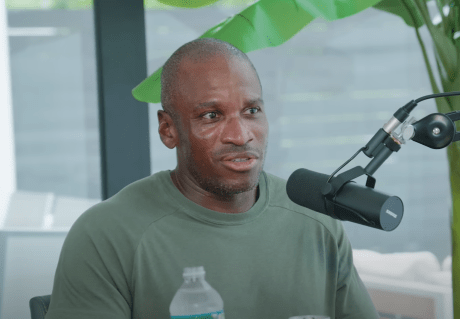

Arthur Hayes, the former BitMEX CEO, has a bold prediction for Bitcoin’s future under a second Trump presidency. He believes a massive Bitcoin price surge is coming, potentially reaching $1 million, but not without a bumpy ride first.

The “KISS” Principle and Liquidity

Hayes’s analysis centers on the “KISS” principle – Keep It Simple, Stupid. He argues that the most important factor influencing asset prices is liquidity – the amount of money available and the interest rates. He warns against getting caught up in daily market noise and instead focusing on the big picture: lots of cheap money means good news for risky assets like Bitcoin.

Trump’s Economic Strategy: Debt-Fueled Growth?

Hayes believes Trump will prioritize a debt-financed “America First” agenda, drastically different from the austerity measures of past administrations. He envisions Trump triggering a recession by slashing federal spending, forcing the Federal Reserve to react with rate cuts and increased liquidity to prevent a financial crisis. This strategy, Hayes argues, is driven by Trump’s desire to be seen as a successful president. The newly formed Department of Government Efficiency (DOGE), led by Elon Musk, plays a role in this scenario by aggressively cutting government waste and potentially causing job losses.

The Fed’s Response: A Flood of Liquidity?

Hayes predicts that the resulting recession will force the Federal Reserve to reverse course, ending quantitative tightening (QT) and potentially restarting quantitative easing (QE). This, combined with lower interest rates, could inject trillions of dollars into the economy. He estimates this could lead to a liquidity injection comparable to the COVID-19 stimulus, potentially causing another massive Bitcoin price surge. He points to the 24x increase in Bitcoin’s price during the 2020-2021 period as an example of what a massive liquidity injection can do.

Short-Term Volatility, Long-Term Bullishness

While Hayes is bullish on Bitcoin’s long-term prospects, he acknowledges potential short-term volatility. He anticipates Bitcoin could revisit the $70,000-$80,000 range before the big surge. However, he views any significant dips as buying opportunities. He believes Bitcoin often bottoms out before traditional markets, making it a good indicator of future trends.

The “Kiss of Death” Redefined

Hayes’s “Kiss of Death” isn’t about Bitcoin failing; it’s about the existing financial system struggling under massive debt and political pressures. He believes the short-term chaos will ultimately lead to a massive increase in liquidity, benefiting Bitcoin significantly.

The Bottom Line: Buy Bitcoin

Hayes’s core message is simple: focus on liquidity, ignore the political drama, and buy Bitcoin. At the time of writing, Bitcoin was trading at $83,725.