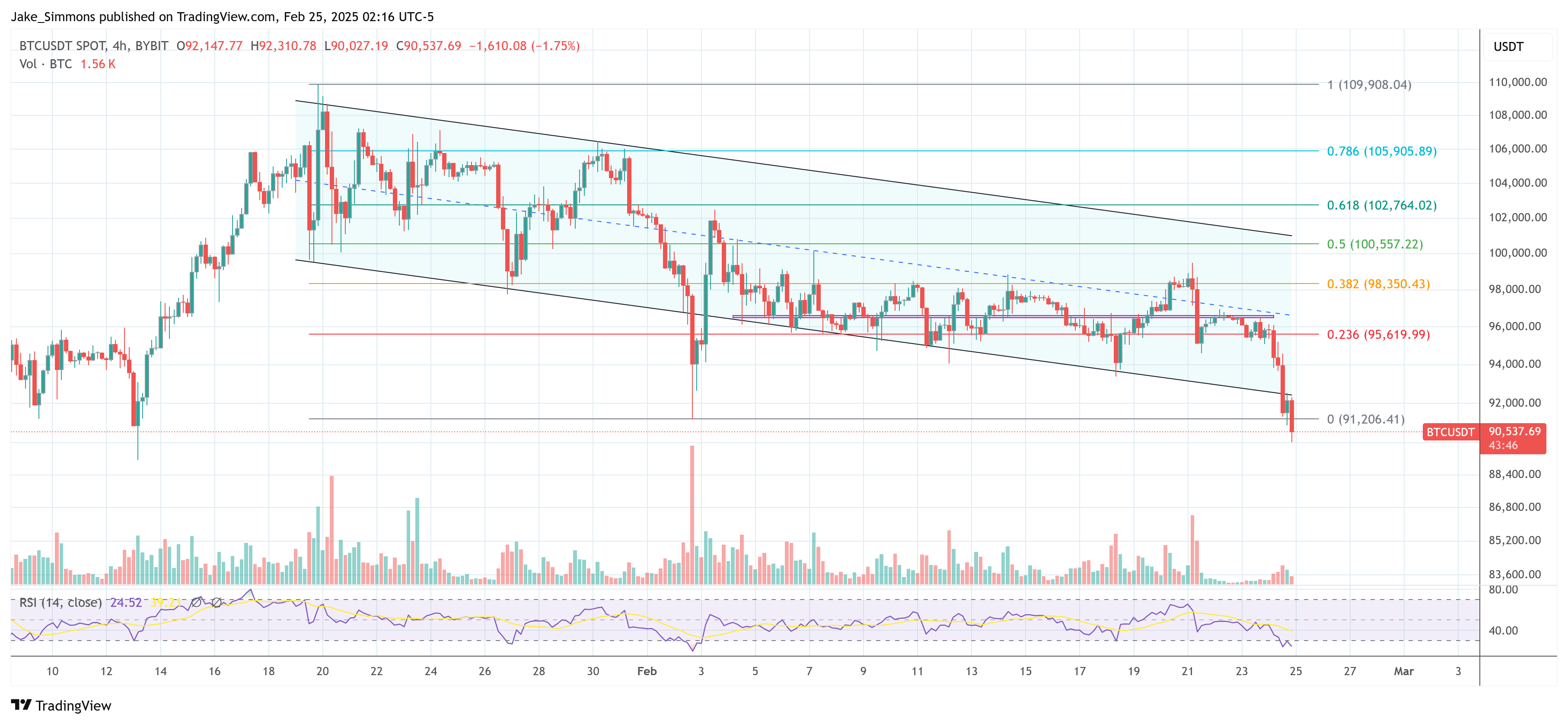

Bitcoin’s price has taken a serious dive. After hitting a high of almost $100,000, it’s now hovering around $90,000 – a significant drop. This downturn is raising concerns and prompting predictions of further declines.

Experts Weigh In: A Possible $73,000 Bottom?

Several experts are sharing their outlooks on Bitcoin’s future. Ari Paul, from BlockTower Capital, believes the stock market might be in for a rough patch (4-15 months), potentially impacting cryptocurrencies. While he sees crypto and stocks as having different cycles, he expects a short-term correlation. He predicts Bitcoin could fall to between $73,000 and $77,000. Despite this prediction, Paul remains optimistic about Bitcoin’s long-term prospects, suggesting a potential bull market resurgence in about six months.

Arthur Hayes, the BitMEX founder, is even more bearish. He points to how Bitcoin ETFs and futures trading could trigger more selling, potentially pushing the price down to $70,000. Research from 10x Research supports this, suggesting that a large portion of the money flowing into Bitcoin ETFs isn’t necessarily from people betting on Bitcoin’s price going up.

Technical Analysis and Market Sentiment

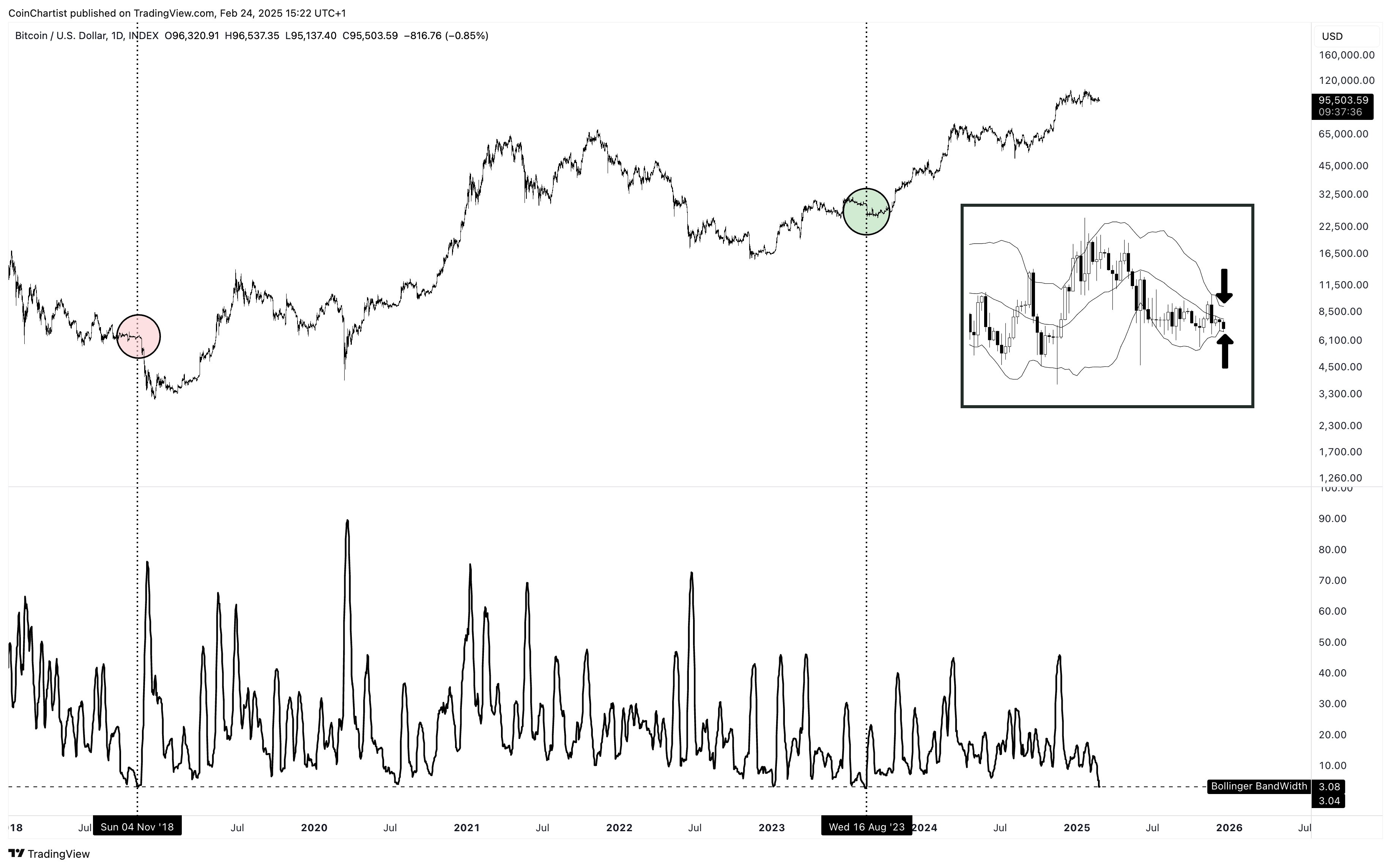

Before the recent drop, technical analyst Tony “The Bull” Severino warned of potential volatility, noting a pattern in the charts that often precedes significant price swings.

The market is definitely feeling the pressure from the recent Bybit hack and the overall uncertainty. The combination of technical indicators, economic concerns, and complex trading strategies makes it hard to predict exactly what will happen next.

However, not everyone is panicking. Chris Burniske from Placeholder VC points out that significant price drops during previous bull markets were common, suggesting that the current situation isn’t necessarily the start of a full-blown bear market.

The Bottom Line

The Bitcoin price is currently unstable. While experts predict a possible drop to the $70,000-$77,000 range, there’s a range of opinions on how long this downturn will last and whether it signals the end of the bull market. Only time will tell.