Analyst Tony Severino predicts Bitcoin’s bull run will end sooner than you think – possibly as early as January 2025. He believes the price won’t break $150,000 before the peak.

The $150,000 Prediction

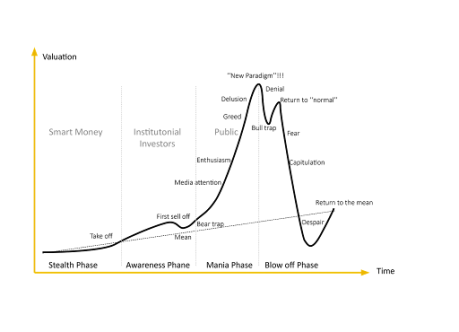

Severino’s prediction is based on his analysis of Bitcoin’s market cycles. He uses charts showing Bitcoin following a classic market cycle pattern. This suggests Bitcoin is in the final stage of its current upward trend (motive wave). Once this wave ends (possibly in January 2025), a corrective wave will begin, kicking off a bear market that could last until mid-2027, potentially dropping Bitcoin’s price as low as $50,000.

Trump’s Impact: Already Priced In?

Severino also points to Donald Trump’s pro-crypto stance as a significant factor. Trump’s election victory fueled a Bitcoin rally, breaking through resistance levels and pushing the price towards $100,000. However, Severino argues that the market has already factored in Trump’s pro-crypto policies, including his proposed Strategic Bitcoin Reserve. This anticipation, he suggests, could create a peak of euphoria, leading to the price top around the time Trump takes office.

Past “New Paradigms” and Market Peaks

Severino highlights two previous instances where the term “new paradigm” was widely used in the crypto space, both of which coincided with market peaks.

- CME Futures Launch:

The anticipation of institutional investment through CME futures didn’t lead to the expected price surge; instead, it marked the start of a bear market.

The anticipation of institutional investment through CME futures didn’t lead to the expected price surge; instead, it marked the start of a bear market. - Coinbase IPO: Similarly, Coinbase going public, despite generating optimism for a $100,000 Bitcoin, ultimately marked a cyclical peak.

The Current Situation

At the time of writing, Bitcoin is trading around $99,200, slightly down from the previous day. Severino’s prediction suggests this could be the beginning of the end of the current bull run.