Lately, Bitcoin’s price has been playing it cool, just chilling after a period of really stepping up its game. Right now, it’s like we’re all on the edge of our seats, watching to see if it’s going to keep climbing or take a bit of a dive.

Let’s dive into some technical analysis by TradingRage.

First up, the daily chart. Since Bitcoin broke through the 200-day moving average back in October, it’s been on a bit of a hot streak, breaking past several resistance levels. Everyone’s feeling pretty upbeat about it.

But hold up, there’s been a bit of a hiccup. Bitcoin tried to jump past $45K but couldn’t quite make it and slipped back towards the $40K support level. This level is basically playing goalie right now, keeping the price from dropping further. If it holds up, we could see Bitcoin aiming for $48K. The Relative Strength Index is still showing more than 50%, so it seems like the buyers still have the upper hand.

Now, let’s check out the 4-hour chart. It gives us a clearer picture of what’s been going down lately. The price has been forming a falling wedge pattern, and it’s still figuring out which way to break.

The $40K support level is nudging the price up towards the higher trendline of the pattern. If it breaks above this wedge, that’s a good sign, and we might see the price soar past $45K and maybe even hit $48K in the next few weeks. But if it goes the other way, watch out – we could see a drop towards $38K.

Switching gears to some on-chain analysi.

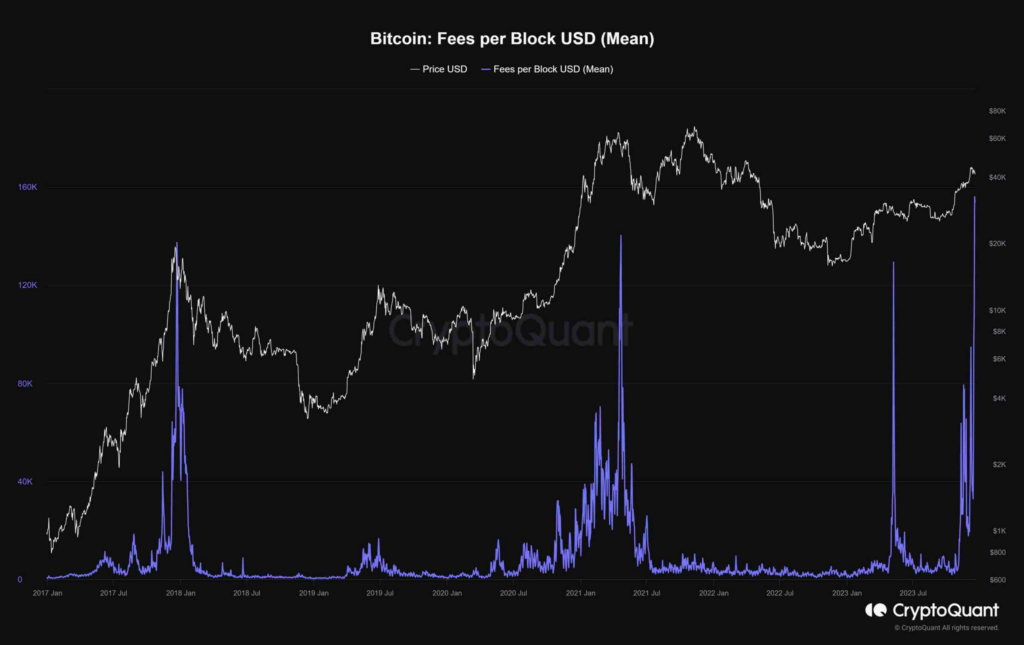

Bitcoin Fees per Block: What’s the Deal? The fees for each Bitcoin block are a big deal because they tell us a lot about what’s happening in the market, like how much the network is being used and how much demand there is. When fees go up, it usually means more people are using the network, and this can sometimes line up with when Bitcoin prices peak. It’s like people are cool with paying more to get their transactions done faster, which shows the market’s buzzing.

Looking back, there’s this pattern where after the fees and prices hit their peak, they usually pull back a bit. This could be because of a bunch of stuff – the network getting too busy, people trading like crazy, investors deciding to sell, or more Bitcoin miners jumping into the market.

With the next Bitcoin halving just 127 days away, there’s a lot of chatter about what might happen. People are wondering if we’ll see some pullbacks because of all the speculation and the moves miners make. This upcoming period is a real test for the market and how investors are feeling. So, keeping an eye on transaction fees, price movements, and other factors is going to be super important for anyone wanting to stay in the loop.