Bitcoin’s price recently dipped below $97,000, a 1.83% drop in a week. Despite this, many still feel bullish because of the 61% price increase since early October. However, some recent trends might suggest otherwise.

The Growing Gap Between Market Price and Realized Price

A crypto analyst, Grizzly, pointed out a significant gap between Bitcoin’s market price and its realized price. While the market price zoomed from around $60,000 to nearly $100,000 in just two months, the realized price (the average price at which all Bitcoins were bought) only climbed from $31,000-$32,000 to $37,000.

This gap is important because:

- Realized price reflects the average cost basis for all Bitcoin holders. A rising realized price usually means more people are buying at higher prices, and long-term holders aren’t selling. This is generally a good sign.

- A widening gap between market price and realized price, however, can signal a speculative bubble. The price might be rising too fast, driven by hype rather than fundamental value.

While this gap could indicate trouble, Grizzly also notes that similar gaps have appeared in past Bitcoin bull runs. The rapid price increases during these periods often cause this discrepancy.

indicate trouble, Grizzly also notes that similar gaps have appeared in past Bitcoin bull runs. The rapid price increases during these periods often cause this discrepancy.

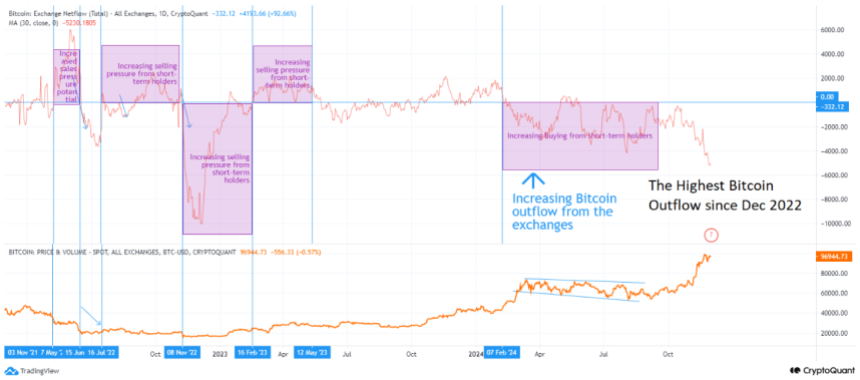

Big Bitcoin Withdrawals from Exchanges: A Bullish Sign?

Adding another layer to the story, a huge amount of Bitcoin has recently left cryptocurrency exchanges – the largest outflow in two years. This suggests that investors are holding onto their Bitcoin rather than selling, which is generally seen as a positive sign for the market. At the time of writing, Bitcoin is valued at $96,468, still up 38.22% over the past month. It remains the dominant cryptocurrency, with a market cap of $1.91 trillion.

The Bottom Line

The situation is mixed. While a large gap between Bitcoin’s market price and realized price can signal an unsustainable price surge, it’s happened before during bull markets. The massive withdrawal of Bitcoin from exchanges, however, points towards a more bullish outlook. Ultimately, whether this is a temporary blip or a sign of things to come remains to be seen./p>