Bitcoin’s price took a bit of a tumble, and trading volume dropped significantly – about 27%! What does this mean for Bitcoin’s future? Let’s dive in.

A Big Price and Volume Drop

According to CoinMarketCap, Bitcoin’s daily trading volume plummeted to $85.89 billion, a massive 26.46% decrease. At the same time, the price dipped below $90,000, down about 2.87% to around $87,848. This lower volume usually suggests less interest in the market, but that’s not necessarily the whole story here.

The Trump Factor and Market Consolidation

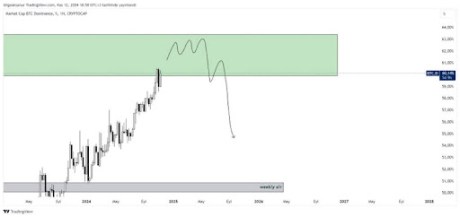

The recent US Presidential election and Donald Trump’s win have kept Bitcoin pretty active lately. So, the drop in volume might not be due to a lack of interest. Instead, it could simply be a period of market consolidation – a pause before a potential price surge. One analyst, “Personal Trader,” even suggests this decline might be Bitcoin’s final correction before a run towards $100,000.

Accumulation vs. Distribution: What’s Happening?

Another analyst, “IonicXBT,” looked at this price and volume drop through the lens of two key Bitcoin market phases: Accumulation and Distribution.

Accumulation Phase:

This is when big players (institutions and savvy investors) start buying Bitcoin. Prices are usually low or have stabilized after a drop, and trading volume increases as buyers push the price higher. Strong upward price movements with high volume are a hallmark of this phase.

Distribution Phase:

This is the opposite – the big players are selling off their Bitcoin. Prices might be at a peak or seem overvalued. You’ll see high volume while the price is falling, showing intense selling pressure. Price spikes with low volume are also a red flag, suggesting smart money is leaving the market.

The Analyst’s Take

Based on these phases, IonicXBT believes Bitcoin isn’t currently in a distribution phase. He thinks it’s still a “buyer’s market,” hinting at potential future price increases. He’s predicting he’ll be able to call the market top and bottom soon.