Bitcoin’s price recently dipped below a key support level, sparking concerns about a potential market correction. Let’s break down what happened and what it might mean.

Below the Short-Term Holder (STH) Realized Price Again

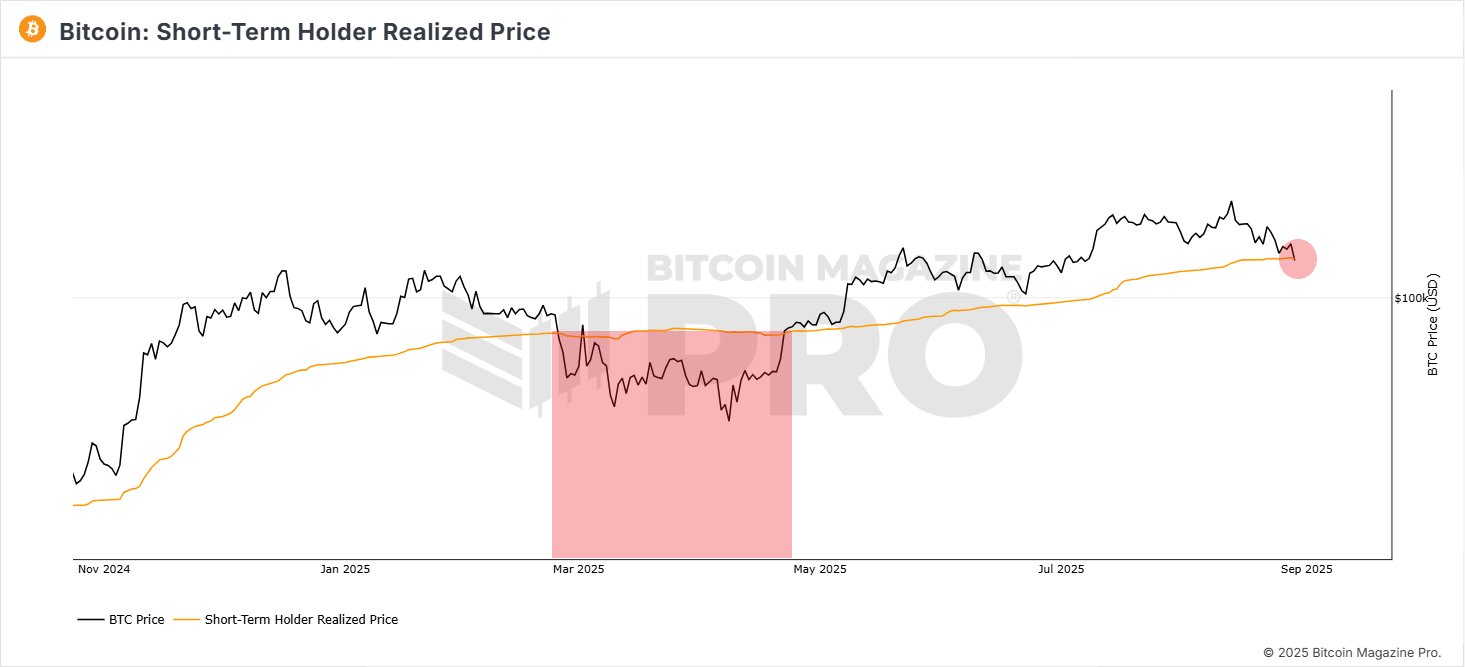

Crypto analyst Burak Kesmeci pointed out that Bitcoin’s price closed below the Short-Term Holder (STH) Realized Price for the second time in 2025. This isn’t good news. The STH Realized Price shows the average price short-term Bitcoin holders (those holding for 155 days or less) paid for their coins. It’s a crucial indicator because these investors are more likely to sell if the price drops.

Think of it like this: When the Bitcoin price is above the STH Realized Price, it’s generally a bullish sign. But when it falls below, it suggests short-term holders might start selling, potentially pushing the price down further.

Deja Vu? February’s Flashback

This isn’t the first time this year Bitcoin’s price has fallen below the STH Realized Price. Back in February, a similar dip triggered a significant correction. Bitcoin lost almost 20% of its value, dropping from around $92,000 to $76,000.

What Could Happen Now?

If history repeats itself, we could see another 20% drop, taking Bitcoin down to around $86,000. Kesmeci describes Bitcoin’s price increases as “step-by-step,” and these dips below the STH Realized Price suggest the correction might continue.

Current Bitcoin Price Situation

While the price has stabilized slightly after a weekend slump, it’s still struggling to break back above $110,000. At the time of writing, Bitcoin is trading around $108,675, up slightly over the past 24 hours but down over 5% in the last week. The situation is definitely worth watching.