Bitcoin’s recent price swings have some analysts worried about a potential crash. The culprit? A gap on the Chicago Mercantile Exchange (CME). Let’s dive into the details.

The CME Gap and Bitcoin’s Potential Drop

Crypto analysts believe Bitcoin needs to “fill” this CME gap, which could send its price tumbling. One analyst, Egrag Crypto, predicts a drop to as low as $77,000.

Egrag points to Bitcoin’s recent history, noting seven significant price drops since October 2022, averaging around 23.53%. He believes a similar drop from the current price (around $109,000) could easily reach the lower end of the CME gap ($77,000 – $80,000). He also highlights the 21-week EMA (around $80,000) as another indicator of a possible crash.

Another Analyst’s Perspective

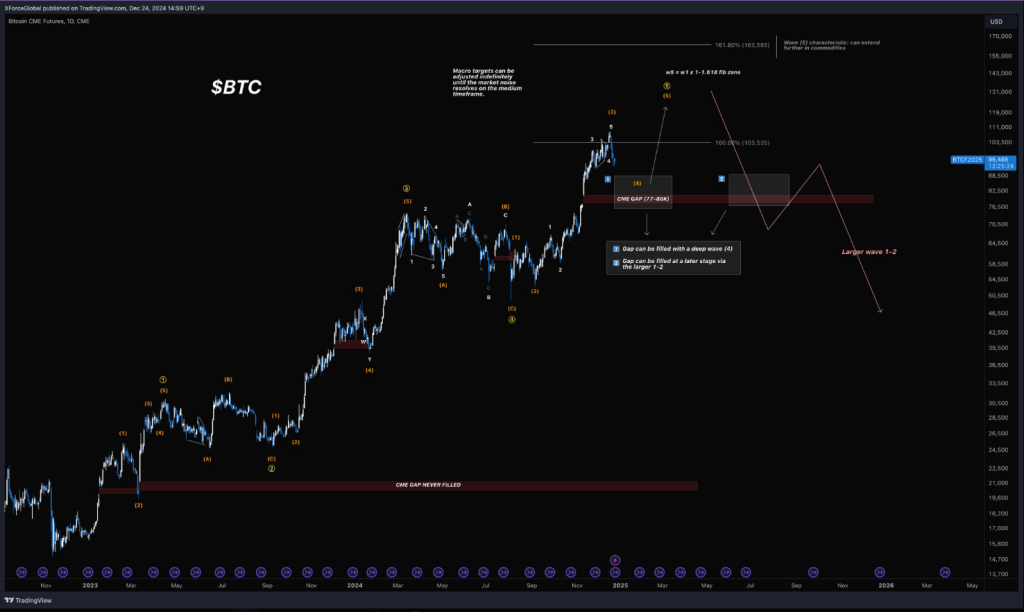

Another analyst, XForceGlobal, agrees that the $80,000 CME gap is significant. Historically, 90% of daily CME gaps of this size have been filled since 2018. However, XForceGlobal cautions that predicting when and  how this gap will be filled is difficult.

how this gap will be filled is difficult.

XForceGlobal outlines two scenarios:

- A sharp correction (wave 4) could push Bitcoin down to the $77,000-$80,000 range.

- The gap might be filled later, after a bull run, potentially leading to a much steeper drop to $46,000.

January’s Inauguration: A Catalyst for a Crash?

Egrag suggests that the upcoming presidential inauguration could trigger a sell-off. Market makers, he argues, often exploit such events. He predicts a significant drop on Inauguration Day (January 20, 2025).

Egrag paints two possible scenarios:

- Bitcoin could briefly pump to $120,000 before crashing to the CME gap, then resume its upward trend in 2025.

- Bitcoin could drop directly to the $70,000-$75,000 CME gap before the bull run resumes.

In short, while nobody can predict the future with certainty, the CME gap presents a real possibility of a significant Bitcoin price drop. The timing and severity remain uncertain, but analysts are keeping a close watch.