Bitcoin’s been on a bit of a rollercoaster lately. After dipping below $100,000, it’s struggling to stay above $94,000. Experts are worried, and for good reason.

A Big Gap in Support

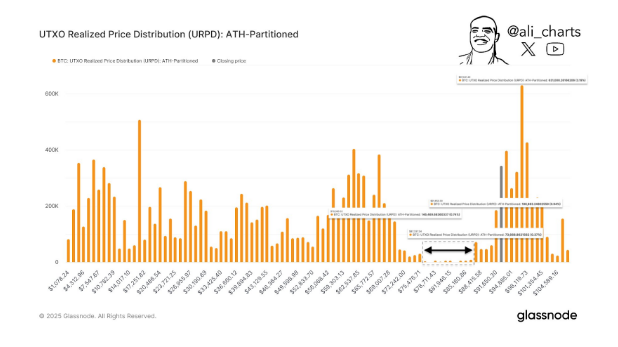

Crypto analyst Ali Martinez points out a significant problem: a $12,000 gap between $87,000 and $75,000. This gap shows up when looking at Bitcoin’s UTXO Realized Price Distribution (URPD). Basically, this means there’s very little historical buying activity in that price range. Think of it like a weak spot in the price floor. If Bitcoin falls below $87,000, there’s nothing to stop it from sliding all the way down to $75,000.

What Does This Mean for Bitcoin?

This $12,000 “void” is a serious threat, but only if Bitcoin breaks below $87,000. While it’s held above $90,000 through recent dips, the recent drop to $91,000 is raising eyebrows. The overall market sentiment is also turning bearish, adding to the concern. A break below $90,000 could trigger a rapid fall to $75,000, which would definitely test investor confidence.

A Silver Lining?

However, there’s another perspective. Some analysts see this consolidation as a buying opportunity. A metric called SOPR (Short-Term Overbought Ratio) is currently below 1, indicating many short-term holders are selling at a loss. Historically, this often precedes a significant price increase, making it an attractive time to buy more Bitcoin for long-term investors.

Currently, Bitcoin is trading around $94,350. The situation is definitely worth watching.