Bitcoin is nearing the $50,000 mark after a week of bullish price action, a level not seen since December 2021. This surge has resulted in over 90% of Bitcoin addresses being in profit.

91% of Bitcoin Addresses Now Profitable as Price Nears $50,000

- Bitcoin’s price action has been eventful, with a recent 14.4% growth to reach $48,500, its highest point in 26 months.

- Despite initial skepticism, this price spike has surprised investors, especially considering the unimpressive action following the debut of spot Bitcoin ETFs in the US.

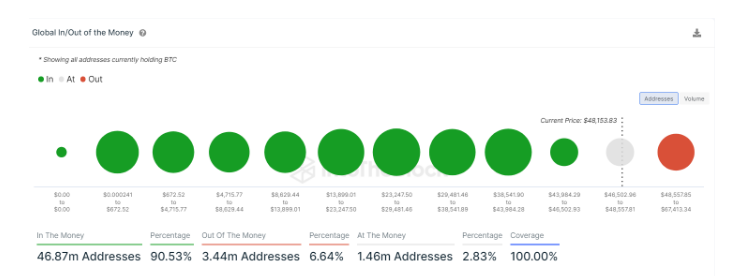

- According to IntoTheBlock’s “Global In/Out of the Money” metric, 46.87 million addresses, representing 90.53% of the total, are now in profit.

- Conversely, 3.44 million addresses (6.64%) are still posting losses, and 1.46 million addresses (2.83%) are at the money or break-even point.

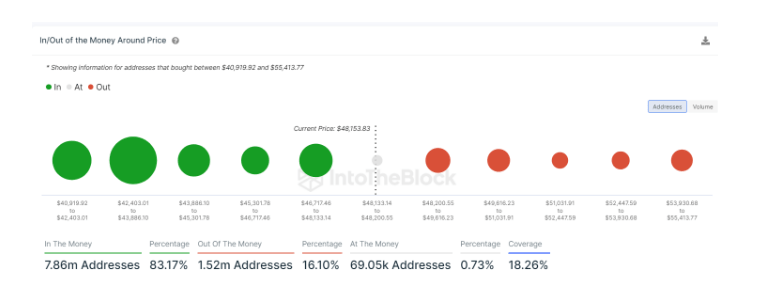

- The “In/Out of the Money Around Price” metric shows that 83.17% of addresses that bought between $40,919.92 and $55,413.77 are in profit.

Bitcoin Set to Keep Shining

- With over 90% of Bitcoin addresses now in profit and the price nearing $50,000, the bull run is expected to continue.

- Last week’s bullish action saw BTC closing over $44,000 on the weekly timeframe for the first time in the current market cycle.

- Spot Bitcoin ETFs now have over $10 billion worth of BTC under management, contributing to the price surge.

- The upcoming halving is another catalyst for a sustained price increase, with historical trends suggesting a parabolic rise after the event.

- Bitcoin could potentially reach $60,000 before the next halving in April and $100,000 before the end of the year.